28.10.2020

W Banku Millennium konto firmowe można założyć w pełni zdalnie dzięki otwartej bankowości

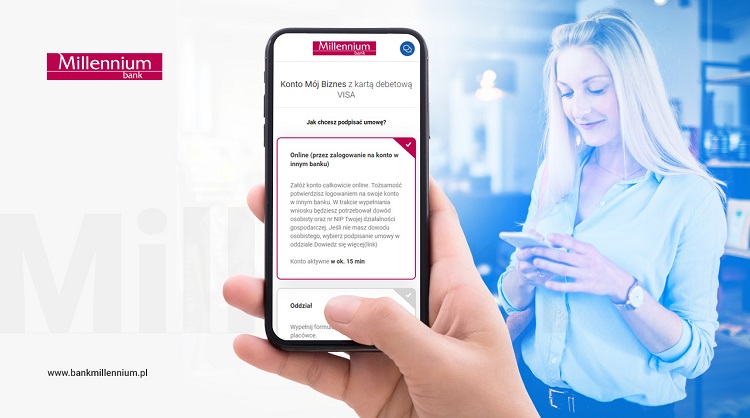

Konto firmowe Mój Biznes można założyć z poziomu telefonu komórkowego. Aby potwierdzić tożsamość, wystarczy zalogować się do konta w innym banku. Obecnie rozwiązanie jest dostępne dla sześciu polskich banków, ale stopniowo będą dodawane kolejne. To pierwsze takie zastosowanie otwartej bankowości na rynku dla klientów firmowych.

Właściciele jednoosobowych działalności gospodarczych, którzy nie mają jeszcze konta w Banku Millennium, mogą teraz założyć konto firmowe Mój Biznes z wykorzystaniem urządzenia mobilnego, bez potrzeby odwiedzania oddziału. Szybko potwierdzą tożsamość logując się do innego banku, w którym mają swoje konto indywidualne, dzięki zastosowaniu usługi dostępu do informacji o rachunku (AIS ang. Account Information Service).

- Wiemy, że klienci cenią szybkie i wygodne rozwiązania, a w dobie pandemii wyjątkowo ważne jest to, żeby większość spraw można było załatwić online. Dlatego udostępniamy w pełni zdalny proces otwierania konta dla właścicieli jednoosobowych firm, którzy szczególnie teraz potrzebują wsparcia. Naturalne dla nas, jako lidera rozwiązań bazujących na możliwościach PSD2, było wykorzystanie w tym procesie otwartej bankowości. Nasi klienci mogą już agregować produkty i wysyłać przelewy z innych banków, a także w kilka chwil potwierdzić swój dochód logując się do innego banku w trakcie wnioskowania o pożyczkę gotówkową, bez konieczności dostarczania dodatkowych dokumentów. Teraz dajemy nowym klientom możliwość szybkiego potwierdzenia swojej tożsamości. Można powiedzieć, że jeśli chodzi o szukanie zastosowań dla otwartej bankowości, jesteśmy najbardziej wszechstronnym bankiem w Polsce - mówi Halina Karpińska Dyrektor Departamentu Bankowości Elektronicznej Banku Millennium.

Aby otworzyć konto firmowe Mój Biznes, należy wejść poprzez urządzenie mobilne na stronę Banku Millennium i wypełnić elektroniczny wniosek. Klient może wybrać, czy chce podpisać umowę w oddziale, czy online. Po wybraniu opcji online i wprowadzeniu podstawowych danych, klient w celu uwierzytelnienia tożsamości jest kierowany do strony logowania jednego z sześciu banków: Alior Banku, Banku Pekao, BNP Paribas, ING Banku Śląskiego, mBanku lub Santander Banku. Po pozytywnej weryfikacji bank poprosi o uzupełnienie kilku danych. Po wprowadzeniu numeru NIP, pozostałe dane firmy uzupełnianie są automatycznie z rejestru CEIDG. Można też od razu zamówić kartę debetową do konta. Następnie należy zatwierdzić dyspozycję otwarcia konta kodem SMS, który przyjdzie na wskazany we wniosku numer telefonu.

Po przejściu prostego i wygodnego procesu klient od razu otrzymuje dane do logowania i może korzystać z nowo otwartego konta poprzez system internetowy Millenet i aplikację mobilną.

- Mamy nadzieję, że nasze nowe rozwiązanie ułatwi prowadzenie biznesu przedsiębiorcom w tym trudnym czasie. Nowy proces to kolejny etap szeroko zakrojonej digitalizacji naszych usług. Wkrótce wniosek będzie dostępny również z poziomu komputera, będziemy też stopniowo dodawać kolejne banki do usługi – dodaje Halina Karpińska.

Właściciele firm jednoosobowych, posiadający konto indywidualne w Banku Millennium, już od dłuższego czasu mogą założyć konto firmowe w pełni onlinelink otwiera się w nowym oknie, w serwisie internetowym i aplikacji mobilnej. Bank Millennium oferuje klientom firmowym jednak znacznie więcej.

- Posiadamy atrakcyjną ofertę, skierowaną do klientów segmentu Biznes prowadzących jednoosobową działalność gospodarczą, jak również do spółek cywilnych i handlowych, z rocznymi przychodami do 5 mln zł. Tej grupie oferujemy szeroką gamę produktów transakcyjnych i kredytowych, ze szczególnym uwzględnieniem korzystnej oferty leasingowej. W ostatnich miesiącach ta grupa klientów skorzystać mogła ze wsparcia m.in. w postaci czasowego odroczenia spłaty kredytów dla firm czy otrzymania subwencji z Tarczy Finansowej PFR. O atrakcyjności naszej oferty i jej dobrym dopasowaniu do potrzeb klienta świadczy jeden z najwyższych poziomów akwizycji nowych kont firmowych w I półroczu 2020 r. oraz blisko 30% wzrost liczby aktywnych klientów Biznes w ujęciu rok do roku, których grono liczy ponad 100 tys – mówi Anna Wydrzyńska–Czosnyka, kierująca segmentem Biznes w Banku Millennium.

Bank Millennium w ramach otwartej bankowości udostępnia już:

- Usługę Finanse 360O, która pozwala sprawdzić stan konta i historię transakcji na rachunku w aż dziewięciu innych bankach: Alior Banku, ING Banku Śląskim, mBanku, Pekao, PKO BP, Santander Banku, BNP Paribas, Inteligo i Citi banku.

- Możliwość inicjowania przelewów poprzez swój serwis internetowy Millenet z kont w PKO BP, mBanku, ING Banku Śląskim, Banku Santander, Alior Banku oraz Banku Pekao.

- Potwierdzanie dochodu w procesie o kredyt gotówkowylink otwiera się w nowym oknie poprzez logowanie do jednego z siedmiu innych banków: Alior Banku, ING Banku Śląskiego, mBanku, PKO BP, Santander Banku, BNP Paribas oraz Inteligo.

Więcej na stronie; https://www.bankmillennium.pl.