12.12.2019

Do 6 mln dofinansowania dla firmy w ramach kredytu na innowacje technologiczne

Trwa nowy nabór wniosków o dofinansowanie unijne do kredytu na innowacje technologiczne. W ramach projektu firmy z sektora MŚP mogą uzyskać bezzwrotną dotację w wysokości do 70% kosztów kwalifikowanych inwestycji, maksymalnie 6 mln zł. Projekt realizowany jest przez BGK, z udziałem m.in. Banku Millennium. Nabór trwa do 23 kwietnia 2020 r.

Program skierowany jest do przedsiębiorstw z sektora MŚP (zatrudniających do 250 pracowników, o rocznym obrocie nie przekraczającym równowartości 50 mln EUR lub sumie bilansowej nie przekraczającej równowartości 43 mln EUR), działających na terytorium Polski. Kredyt w ramach projektu udzielany jest na wdrożenie własnej nowej technologii lub zakup i wdrożenie technologii i wytworzenie dzięki niej nowych lub znacząco ulepszonych towarów, procesów lub usług (w stosunku do dotychczas wytwarzanych na terytorium Polski).

- Możliwość otrzymania bezzwrotnej dotacji na tak wysoką kwotę jest bardzo atrakcyjna, dlatego zainteresowanie firm programem jest duże. W obecnej perspektywie (2014-2020) wsparcie otrzymało dotychczas 771 projektów, a jego łączna wartość to 2,7 mld zł. Wskazaniem do ubiegania się o dotację są poprawa jakości, nowe usługi bądź procesy, takie jak np. optymalizacja kosztowa związana z automatyzacją, robotyzacją i digitalizacją przedsiębiorstwa, której celem jest zwiększenie wydajności produkcji i w efekcie wytworzenie na ich podstawie znacząco ulepszonych procesów, towarów czy usług. Co istotne przedsiębiorca może wdrożyć nie tylko własną technologię, ale również tę zakupioną – mówi Agnieszka Kucharska, Kierująca Zespołem Produktów i Procesu Kredytowego w Banku Millennium.

Warunkiem uzyskania dofinansowania jest uzyskanie promesy kredytu na innowacje technologiczne w banku komercyjnym, m.in. w Banku Millennium, a następnie podpisanie umowy o kredyt. W Banku Millennium możliwe jest dodatkowo sfinansowanie kredytem komercyjnym wymaganego w projekcie udziału własnego w wysokości 25%. Premia technologiczna (dotacja) jest bezzwrotna i przeznaczona na spłatę kapitału kredytu banku komercyjnego. Firma może wnioskować o częściową wypłatę dotacji już po zrealizowaniu 25% wartości inwestycji. Więcej informacji na stronie https://www.bankmillennium.pl/przedsiebiorstwa.

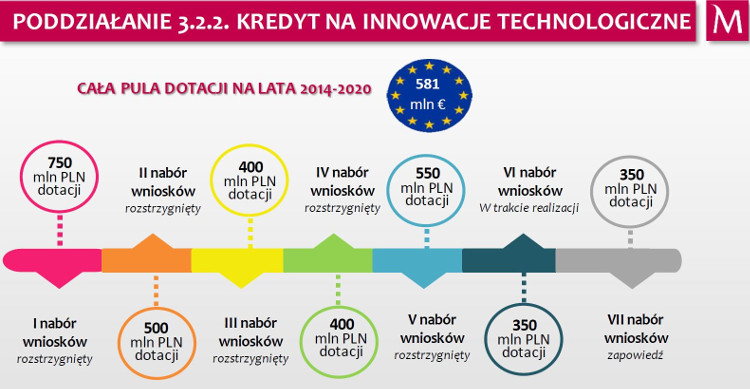

Zapowiedziano też kolejny, VII konkurs w ramach poddziałania 3.2.2 POIR z bezzwrotną dotacją unijną. W ramach planowanego harmonogramu nabór wniosków rozpocznie się 24 września 2020 r., a zakończy 30 grudnia 2020 r. Przewidywana pula środków to 350 mln zł.