03.02.2020

2019 rok w Banku Millennium – udana fuzja z Euro Bankiem, 734 tys. nowych aktywnych klientów, dwucyfrowe wzrosty wartości portfela kredytów (+32%) i depozytów (+23%) Grupy, wysoki wzrost organiczny

Wstępne wyniki i działalność Grupy Banku Millennium po 4 kwartałach 2019 roku

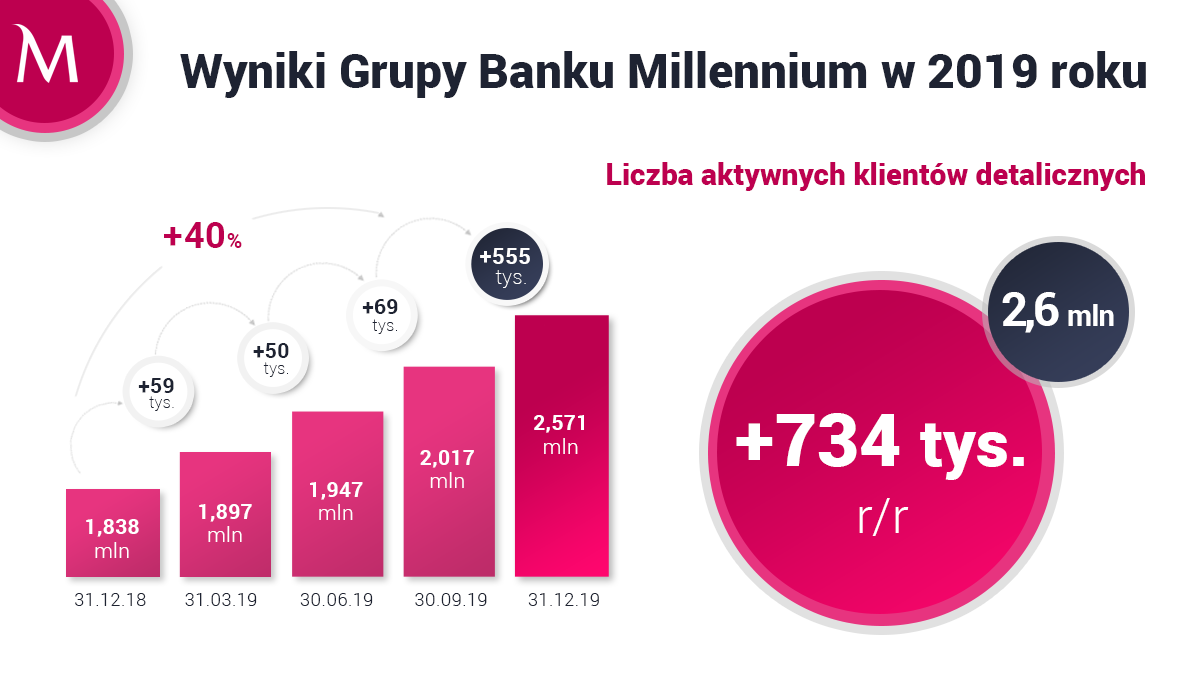

Skonsolidowany zysk netto Grupy Banku Millennium w 2019 roku wyniósł 561 mln zł (-26% r/r). Gdyby nie jednorazowe koszty i rezerwy, głównie na integrację z Euro Bankiem i ryzyko prawne portfela kredytów walutowych, wyniósłby 889 mln zł (+17% r/r). O 734 tys. (+40% r/r) wzrosła liczba aktywnych klientów detalicznych do poziomu 2,6 mln. Rekordowa sprzedaż pożyczek gotówkowych oraz efekt połączenia przyniosły podwojenie wartości portfela kredytów konsumpcyjnych do 15,1 mld zł. Depozyty klientów Grupy osiągnęły wartość 81,5 mld zł (+23% r/r), a kredyty 69,8 mld zł (+32% r/r).

- Najważniejszym wydarzeniem 2019 roku była szybka i perfekcyjnie przeprowadzona fuzja z Euro Bankiem, która skokowo zwiększyła potencjał rozwojowy banku. Po połączeniu, na koniec 2019 roku Grupa Banku Millennium posiada aktywa w wysokości 98,1 mld zł, kapitały własne w wysokości 9 mld zł i obsługuje 2,6 mln aktywnych klientów detalicznych. Pomimo kosztów integracji i konieczności utworzenia rezerw jestem zadowolony z osiągniętego wyniku 561 mln zł zysku netto. Pokazuje on skuteczność realizacji strategii wzrostu organicznego i innowacyjnej przewagi banku na rynku. Mimo ogromnego zaangażowania w proces łączenia z Euro Bankiem uruchomiliśmy w tym roku m.in. bankowość nowej generacji – spersonalizowany dla każdego klienta, nowy serwis bankowości internetowej i mobilnej oraz wkroczyliśmy w świat otwartej bankowości - mówi Joao Bras Jorge, Prezes Zarządu Banku Millennium.

Najważniejsze skonsolidowane wyniki finansowe Grupy

Skonsolidowany, nieaudytowany zysk netto Grupy Banku Millennium w 2019 roku wyniósł 561 mln zł i był o 26% niższy, niż w analogicznym okresie roku 2018. Na wynik wpłynęło kilka zdarzeń nadzwyczajnych, z których najważniejszym było przejęcie Euro Banku 31 maja 2019 roku. W okresie ostatnich 12 miesięcy Bank rozpoznał w łącznej kwocie 205 mln zł koszty i rezerwy związane z połączeniem (166 mln zł po opodatkowaniu). Na wynik pozytywnie wpłynęły 27 mln zł z tytułu odzyskania aktywa podatkowego oraz 45 mln zł zysku kapitałowego z tytułu przeszacowania udziałów w spółce PSP. Istotną pozycją nadzwyczajną jest także rezerwa w wys. 223 mln PLN na ryzyko prawne związane z walutowymi kredytami hipotecznymi zawiązana w 4 kw. Po skorygowaniu o wszystkie dodatkowe koszty i zyski zysk netto wyniósłby 889 mln zł (+17%).

Fuzja z Euro Bankiem, zakończona skuteczną migracją wszystkich placówek, klientów i produktów na markę i systemy Millennium, umożliwiła wzrost o 22% aktywów ogółem do 98,1 mld zł. Depozyty klientów osiągnęły wartość 81,5 mld zł, a kredyty 69,8 mld zł. Pomimo fuzji, Grupa zamknęła 2019 rok solidną nadwyżką płynności (relacja kredytów do depozytów poniżej 86%) i mocną pozycją kapitałową (łączny współczynnik kapitałowy 20,1%). Wskaźnik koszty/dochody wyniósł 49,7%, a po skorygowaniu o pozycje jednorazowe 47,4%. Zwrot z kapitału ROE za 2019 rok, skorygowany o pozycje jednorazowe, wyniósł 10,2% i był wyższy o 0,6 p.p. niż w roku poprzednim.

Solidna rentowność operacyjna pod wpływem przejęcia Euro Banku:

- skonsolidowany zysk netto po 4 kwartałach 2019 roku wyniósł 561 mln zł (-26% r/r), po odjęciu pozycji nadzwyczajnych wyniósłby 889 mln zł (+17%)

- zysk netto w 4 kwartale 2019 wyniósł 27 mln zł (274 mln zł po skorygowaniu o pozycje nadzwyczajne)

- koszty integracji i rezerwy związane z Euro Bankiem: 205 mln zł

- rezerwy na ryzyko prawne związane z walutowymi kredytami hipotecznymi: 223 mln zł (powiększona z poziomu rezerwy o wartości 150 mln PLN, o której utworzeniu Bank poinformował 16 stycznia 2020)

- skorygowany ROE: 10,2%; skorygowany wskaźnik koszty/dochody: 47,4%

Wpływ integracji z Euro Bankiem na dochody i koszty:

- przychody operacyjne wzrosły o 27% r/r

- wynik z pozycji odsetek wzrósł o 33% r/r

- koszty operacyjne wzrosły o 36% r/r (28% bez kosztów integracji)

- rezerwa na zwroty prowizji od spłaconych przed terminem kredytów konsumpcyjnych 66 mln zł

Najważniejsze wyniki biznesowe

Bankowość detaliczna

Od początku roku Bank powiększył bazę aktywnych klientów o rekordową liczbę 734 tys., co stanowi wzrost o 40% w skali roku (+264 tys. w wyniku wzrostu organicznego). Na dzień 31 grudnia Bank obsługiwał 2,6 mln aktywnych klientów detalicznych, w tym 494 tys. dawnego Euro Banku. Z bankowości elektronicznej korzystało aktywnie 1,8 mln klientów (+32% r/r), a z aplikacji mobilnej 1,41 mln (+44% r/r).

Bank rozwijał model biznesowy oparty na dalszej digitalizacji i ponownie zwiększył udział kanałów cyfrowych w sprzedaży produktów. Przykładowo udział cyfrowych kanałów w akwizycji pożyczek gotówkowych wyniósł 53%. Z pozostałych usług online największy wzrost odnotowały transakcje BLIK-iem (+99% r/r) i liczba kart aktywowanych w technologii HCE (+ 362%).

Produktem budującym doskonałe tempo akwizycji nowych klientów było zwyczajowo Konto 360°, wspierane kampaniami w mediach, dobrą współpracą z partnerami i programem rekomendacyjnym „Lubię to Polecam”. Na koniec roku program miał już 670,9 tys. uczestników, z czego w samym 2019 roku przybyło ich prawie 294 tys.

Mimo ogromnego zaangażowania w proces łączenia z Euro Bankiem, 2019 rok przyniósł dalszy rozwój akcji kredytowej Banku. Sprzedaż pożyczek gotówkowych osiągnęła rekordową wartość 4,1 mld zł, (+28% r/r) (sprzedaż Euro Banku ujęta od 9 listopada 2019 roku). Znakomita sprzedaż oraz efekt połączenia przyniosły podwojenie wartości portfela kredytów konsumpcyjnych do 15,1 mld zł.

Bank utrzymał również wysoką pozycję na rynku kredytów hipotecznych. Ich sprzedaż osiągnęła solidną wartość 4,2 mld zł (+26% r/r) (sprzedaż Euro Banku ujęta od 9 listopada 2019 roku). Był to wzrost dużo wyższy niż 17% wzrost rynku w tym samym czasie. Wynik ten dał szóste miejsce w rankingu kredytodawców hipotecznych, z udziałem w rynku na poziomie 7,3%.

Łączna wartość kredytów dla klientów indywidualnych na dzień 31 grudnia 2019 roku osiągnęła poziom 52,6 mld zł brutto (+44% r/r; +9% r/r bez Euro Banku).

Mimo niekorzystnego otoczenia rynkowego - niskich stóp procentowych, konkurencji ze strony innych banków, rynku nieruchomości i obligacji skarbowych - Bank wykorzystał rosnące na rynku środki osób fizycznych. W 2019 roku łączny wzrost wolumenu depozytów klientów detalicznych wyniósł 13,9 mld zł (+28% r/r; +10% r/r bez Euro Banku ), osiągając wartość 61,1 mld zł.

Bank osiągnął również najwyższy poziom akwizycji nowych kont firmowych dla klientów Biznes (działalność gospodarcza z przychodami do 5 mln zł) odnotowując 97% r/r wzrost sprzedaży (wzrost liczby nowych klientów o ponad 22 tys.). Na dzień 31 grudnia 2019 roku Bank posiadał prawie 89 tys. aktywnych klientów segmentu Biznes.

Nowe rozwiązania w Millenecie i aplikacji mobilnej dla klientów indywidualnych

- bankowość nowej generacji. Bank uruchomił nowy serwis bankowości internetowej Millenet oraz aplikację mobilną, w pełni spersonalizowane dla każdego klienta. Do ich budowy zastosowano unikatowe na polskim rynku technologie i rozwiązania, a także wyjątkowy design, które zapewniają klientom zupełnie nowe cyfrowe doświadczenie.

- automatyczna płatność za autostrady. Jako pierwszy bank w Polsce, Bank udostępnił w aplikacji mobilnej Autopay - automatyczną płatność za autostrady firmy Blue Media. Dzięki niej klienci mogą przejechać autostradą bez potrzeby zatrzymywania się przy bramkach. Opłata pobierana jest automatycznie z konta lub karty kredytowej klienta.

- udostępnienie ApplePay, płatności zbliżeniowych telefonem oraz smartwatchem dla użytkowników systemu operacyjnego iOS. Z ApplePay mogą korzystać użytkownicy kart debetowych i kredytowych Visa oraz Mastercard.

- wspieranie e-administracji i programów rządowych w Millenecie. Bank umożliwił wnioskowanie o świadczenie rodzinne z programów Rodzina 500+ i Dobry Start 300+ zgodnie z nowymi założeniami (od 1 lipca 2019 roku). Wdrożył również możliwość płacenia podatku dochodowego bezpośrednio w serwisie Twój e-PIT. Klienci mogą teraz za pośrednictwem Millenetu regulować należności wobec urzędu skarbowego bez potrzeby opuszczania serwisu podatkowego. Wszystkie dane przelewu podstawiają się automatycznie.

- tymczasowa blokada kart w aplikacji mobilnej i odblokowywanie haseł w Millenecie. Wśród nowych rozwiązań klienci mogą korzystać z wygodnego, tymczasowego blokowania kart płatniczych w aplikacji (blokadę można włączać i wyłączać dowolną ilość razy) oraz szybkiego, w pełni online odblokowywania hasła do systemu Millenet.

Otwarta bankowość i dostosowanie do standardów PSD2

W 2019 roku Bank dostosował swoje usługi do wymogów unijnej dyrektywy PSD2. Wprowadził nową metodę aktywacji kanałów elektronicznych oraz dodatkowe zabezpieczenia przy logowaniu i uwierzytelnianiu operacji. Jako jeden z pierwszych udostępnił interfejs produkcyjny otwartej bankowości w standardzie Polish API. Rozpoczął też pilotaż usługi agregacji kont i informacji o rachunkach z innych banków w swojej aplikacji mobilnej i systemie bankowości internetowej.

Bankowość przedsiębiorstw

Pomimo ograniczonego zapotrzebowania rynku na finansowanie, wolumen wszystkich produktów kredytowych udzielonych firmom – kredyty na finansowanie bieżących potrzeb, kredyty inwestycyjne, leasing, produkty finansowania handlu i te z udziałem środków unijnych – wzrósł w 2019 roku o 7% r/r do poziomu 18,6 mld zł netto. Wzrost obserwowany był również w finansowaniu bieżącym (o 13% r/r) i kredytach inwestycyjnych (o 8% r/r).

Pod względem wartości zrealizowanych obrotów faktoringowych w wysokości 21 mld zł, Bank znalazł się na 6 miejscu wśród instytucji faktoringowych zrzeszonych w Polskim Związku Faktorów, z 7,5% udziałem w rynku. Aktywa faktoringowe na koniec 2019 roku wyniosły 2,7 mld zł brutto czyli wzrosły o 3% r/r. W obszarze finansowania handlu odnotowano znaczący wzrost sumy udzielonych nowych limitów - aż o 36% r/r, a wartość portfela czynnych gwarancji i akredytyw osiągnęła 0,9 mld zł.

Wartość uruchomionych w ciągu roku umów leasingu wyniosła ogółem 3,5 mld zł, co oznacza wynik na poziomie 2018 roku. O skali działalności świadczy podpisanie ponad 231 tys. umów od początku istnienia spółki. Wg stanu na 31 grudnia 2019 roku wartość zaangażowanego kapitału w czynne umowy leasingu wyniosła 6,8 mld zł brutto (+5,4% r/r).

Efektem wysokiej jakości oferowanych usług i pogłębiających się relacji z klientami jest dalszy wzrost transakcyjności. W konsekwencji w 2019 roku znacząco wzrósł wolumen środków na rachunkach bieżących, osiągając w grudniu rekordowy poziom 11,4 mld zł (+19% r/r). Łączna wartość zdeponowanych środków klientów biznesowych (w tym SME) wyniosła 20,36 mld zł rosnąc 10% w skali roku.

Bank kontynuował współpracę z Klubem CFO stworzonym przez wydawcę Harvard Business Review Polska. W ramach Klubu przedstawiciele Banku przygotowywali publikacje, współprowadzili webinaria i spotkania, poświęcone w tym roku cyberbezpieczeństwu, zarządzaniu ryzykiem strategicznym i rozwojowi kompetencji przywódczych dyrektorów finansowych. Bank współpracował również z magazynem „Forbes” w ramach dwóch strategicznych inicjatyw - był partnerem strategicznym Forum Firm Rodzinnych oraz dwunastej edycji Diamentów miesięcznika „Forbes”, łącznie z rankingiem polskich przedsiębiorstw przygotowanym przez magazyn.

Cyfrowe ułatwienia dla klientów korporacyjnych

- Bank zaoferował klientom token sprzętowy z czytnikiem, innowacyjne urządzenie do logowania i autoryzacji zleceń. Jest to pierwsze w Polsce rozwiązanie oparte na autorskiej technologii Cronto firmy OneSpan. Urządzenie zapewnia najwyższy poziom bezpieczeństwa oraz unikalną dla tego typu urządzeń wygodę użytkowania.

- Jako jeden z pierwszych banków Millennium wprowadził możliwość sprawdzenia rachunku na białej liście podatników VAT bezpośrednio w formularzu przelewu w bankowości elektronicznej. Dzięki usłudze znacznie skrócono czas potrzebny przedsiębiorcy na realizację przelewu do kontrahenta.

- Bank wdrożył mikrorachunek do płatności podatków, intuicyjny proces, który wskazuje każdemu klientowi-podatnikowi który rachunek powinien zostać użyty dla danego symbolu formularza. Przykładowo, jeśli jest to VAT, system wskazuje, by wpisać Indywidualny Rachunek Podatkowy (w tym mikrorachunek urzędu skarbowego).

- We współpracy z Millennium Leasing Bank rozwijał internetowy moduł obsługi produktów leasingowych, dostępny dla klientów jako część Millenetu. Moduł umożliwia podgląd online najważniejszych informacji dotyczących umów leasingu, związanych z nimi ubezpieczeń, a także podgląd i opłacanie faktur.

- Zoptymalizowano proces realizacji przelewów zagranicznych w aplikacji mobilnej. Dzięki uproszczeniu sposobu identyfikacji banku odbiorcy, na podstawie wprowadzonych danych użytkownik może skorzystać z wyszukiwarki banków. Jeżeli dane będą unikalne tylko dla jednego banku, reszta danych zostanie automatycznie podstawiona na formularzu przelewu.

- Bank udoskonalił usługę MillenetLink, kanał bezpośredniej komunikacji z systemami ERP (Enterprise Resource Planning) klientów. By zapewnić sprawną integrację systemów bankowych i klienckich, Bank nawiązał współpracę z producentami/dostawcami wiodących systemów ERP. Od czerwca klienci posiadający systemy firmy Comarch mogą aktywować MillenetLink bez konieczności dodatkowych modyfikacji tych systemów.

Wyniki Grupy dostępne są również pod adresem: https://www.bankmillennium.pl/o-banku/relacje-inwestorskie/raporty-biezace/-/r/27823427