Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

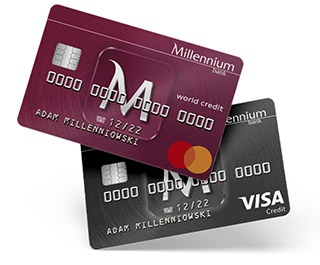

Update the browserOne card for currency payments

Use your credit card to pay for everyday purchases. It is also perfect for abroad - thanks to the currency limit.

- You have access to world currencies at favourable Visa or Mastercard rates

- You can pay up to PLN 5,000/month without an additional exchange margin

- When you use up the limit, the bank's additional margin will be 2%

Get 5% cashback on shopping

Pay by Impresja credit card and get cashback

5% cashback on shopping - up to 50 PLN a month

cashback is automatically transferred to your card account

24 Partners in programme: Apart, Baldinini, Bershka, Cinema City, Coccinelle, Deichmann, Empik, Francesco Biasia, Inter Cars, Massimo Dutti, Max Mara, Marella, Oysho, Pennyblack, Pollini, Pull&Bear, Sony Centre, Sephora, Smyk, Stradivarius, travelplanet.pl, Venezia, Zara, Zara Home

5% cashback applies to purchases in Empik stores, Sony Centre stores, Smyk stores and Cinema City (box offices), in case of Inter Cars only to online shopping at www.intercars.pl. It is not valid for Weekend Max Mara.

Details in "Moneyback for Impresja cards" programme regulationsopens in a new card (in Polish).

24 Partners in programme

Moneyback

If you use Impresja card (card agreement concluded in the period from 1.05.2013 to 10.11.2019) in order to participate in "Moneyback" programme after 1.01.2021, it could be necessary to sign the annex to your card agreement changing the interest rate (APR 18.28%). Annex can be accepted in Millenet or in the mobile application, at any Bank Millennium branch, as well as via TeleMillennium at 801 331 331 (call cost according to the operator's rate).

Click to Pay - fast and secure online payments

You can add your Mastercard to the Click to Pay service, which makes it easy to pay for online purchases. When you use Click to Pay, you don’t need to provide your card details to stores during checkout. Details are stored in Click to Pay and encrypted, giving you extra protection for online shopping.

How to use it

- Add your card to Click to Pay on the Mastercard Click to Pay ProfileThe link opens in a new tab. page

- Select Click to Pay as the payment method on the store’s website (if available)

- Log in to Click to Pay using the email address linked to the service

- Confirm the payment in our mobile app

Benefits

Contactless payments

Contactless paymentsIt's a comfortable way of paying without a wallet. Activate your virtual card free of charge and pay conveniently by phone.

Currency Limit

Currency LimitYou have access to world currencies at favourable Visa or Mastercard rates - up to PLN 5,000/month without an additional exchange margin. When you use up the limit, the bank's additional margin will be 2%.

Convenience of payment

Convenience of paymentComfortable shopping in stores or online stores and payments under the card limit.

Easy Instalments (APR 1.87%)

Easy Instalments (APR 1.87%)The Easy Instalments Programme allows a repayment of spending done with the credit card in equal instalments with an attractive interest rate.

3D-Secure

3D-SecureGuarantee of the highest level of safety of Internet transactions provided by free 3D-Secure service.

Full service comfort

Full service comfortControl over expenses based on self-established daily limits. At any time, you may also check your account balance.

INSPIRATIONS

PROGRAMME

INSPIRATIONS

How to use

-

Millenet

MillenetMillenet is an online banking system providing security and full 7/24 online control over your finances and additional services.

-

Mobile app

Mobile appThe mobile app allows you to use the account on your phone, wherever you are. You can make transfers, pay in stores, withdraw cash from ATMs and much more.

-

Branches and ATMs

Branches and ATMsBank Millennium provides over 600 branches throughout Poland and multifunctional Bank Millennium ATMs.

Fixed line calls and mobile

Costs

- * The first monthly fee shall be charged for the second full month from issuing the card. Subsequent monthly fees shall be charged in arrears – for the previous month. Fees are not charged for a minimum of 5 non-cash card transactions in the previous month.

Required documents

If you have been transferring your salary to an account in Bank Millennium for at least 3 months, all formalities will be limited to a minimum. The key document, which is required each time is an ID card. There is a list of documents below confirming income depending on its source.

- Employment contract / contract of mandate / specific-task contract

- Sole proprietorship

- Retirement pension

- Disability pension

- Pre-retirement benefit

One of the options below:

- confirmation of salary transfers over the last 3 months

- PIT for the whole previous tax year

- proof of income

- annual tax return and a certificate from the Tax Office or a certificate from the ZUS/KRUS

- revenue and expense ledger

- confirmation of pension transfer for the last month

- last pension payslip

- last decision on indexation

- last decision on pensionable remuneration

- confirmation of disability pension transfer for the last month

- last disability pension payslip

- last decision on remuneration

- decision on granting the disability retirement pension

- confirmation of benefit transfer for the last month

- last benefit payslip

- last decision on remuneration

- decision on granting the benefit

How to get

- Online application

-

If you are not our Client, contact us.

If you are our Client, apply in Millenet or in the Mobile App.

- TeleMillennium

-

- In our branches

-

How to restrict

Lost or stolen card should be restricted immediately. Call one of the special numbers:

-

-

801 331 331

TeleMillennium phone number for fixed line callers and mobile callers

-

+48 22 598 40 40

TeleMillennium phone number for mobile or international callers

A card can be also restricted in Millenet and mobile app.

how to restrict card Find out moreImportant information

- ???link.opens.in.new.window??? Fee information document - Visa Impresja

- ???link.opens.in.new.window??? Fee information document - MasterCard Impresja

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 15 August 2021 - in Polish

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 4 December 2021 – in Polish

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 25 April 2022 - in Polish

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 1 September 2022 - in Polish

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 15 March 2023 - in Polish

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 21 April 2023 - in Polish

- ???link.opens.in.new.window??? Daily limits for payments cards – information from 1 July 2024 - in Polish

- ???link.opens.in.new.window??? Daily limits for payment cards – information from 21st October 2024 - in Polish

- ???link.opens.in.new.window??? Daily limits for payment cards – information from 13rd January 2025 - in Polish

- ???link.opens.in.new.window??? Price list - credit cards - in Polish – valid for agreements concluded from 21.10.2024

- ???link.opens.in.new.window??? Price list - credit cards - in Polish – valid for agreements concluded till 20.10.2024

- ???link.opens.in.new.window??? Credit Card Regulations - for agreements concluded from 20.10.2021 (in Polish)

- ???link.opens.in.new.window??? Credit Card Regulations (valid for Bank Millennium credit cards and for credit cards from eurobank’s offer) - for agreements concluded till 19.10.2021

- ???link.opens.in.new.window??? Credit Card Regulations - for agreements concluded from 21st October 2024 (in Polish)

- ???link.opens.in.new.window??? Credit Card Regulations - for agreements concluded from 20.10.2021 - version from 1st April 2025 (in Polish)

- ???link.opens.in.new.window??? Credit Card Regulations (valid for Bank Millennium credit cards and for credit cards from eurobank’s offer) - for agreements concluded till 19.10.2021 - version from 1st April 2025 (in Polish)

- ???link.opens.in.new.window??? Credit Card Regulations - for agreements concluded from 28.06.2025 - version from 28th June 2025 (in Polish)

- ???link.opens.in.new.window??? "Udane zakupy z kartą kredytową Millennium" promotion regulations (in Polish)

- ???link.opens.in.new.window??? "Wiosna z kartą kredytową Millennium" promotion regulations - in Polish

- ???link.opens.in.new.window??? "Lato z kartą kredytową Visa" promotion regulations - in Polish

- ???link.opens.in.new.window??? „Karta kredytowa Visa Impresja i Alfa w Goodie” promotion regulations (in Polish)

- ???link.opens.in.new.window??? „Karta kredytowa Mastercard Impresja w Goodie” promotion regulations (in Polish)

- ???link.opens.in.new.window??? "Jesień z kartą kredytową Mastercard" - promotion regulations - in Polish

- ???link.opens.in.new.window??? Moneyback for Impresja cards” program regulations valid till 31st January 2026 – in Polish

- ???link.opens.in.new.window??? Moneyback for Impresja cards” program regulations valid from 1st February 2026 – in Polish

- ???link.opens.in.new.window??? "Bonus 400 zł z kartą kredytową Mastercard" promotion regulations (in Polish)

- ???link.opens.in.new.window??? Regulamin promocji "Płatność kartą kredytową Visa"

- ???link.opens.in.new.window??? "Z kartą kredytową Visa w Banku Millennium" lottery promotion regulations - in Polish

- ???link.opens.in.new.window??? "Odbierz 300zł do Allegro z kartą kredytową Mastercard" promotion regulations - in Polish

- ???link.opens.in.new.window??? "300 zł do Allegro z kartą kredytową Mastercard" promotion regulations - in Polish

- ???link.opens.in.new.window??? "300 zł z kartą kredytową Visa" promotion regulations - in Polish

- ???link.opens.in.new.window??? "ODBIERZ DO 300 ZŁ NA ZAKUPY W BIEDRONCE Z KARTĄ KREDYTOWĄ MASTERCARD" promotion regulations (in Polish)

- ???link.opens.in.new.window??? "DO 300 ZŁ NA ZAKUPY Z KARTĄ KREDYTOWĄ VISA" promotion regulations (in Polish)

- ???link.opens.in.new.window??? "Zakupy z kartą kredytową VISA" promotion regulations (in Polish)

- ???link.opens.in.new.window??? „DO 400 ZŁ Z KARTĄ KREDYTOWĄ VISA IMPRESJA” promotion regulations (in Polish)

- ???link.opens.in.new.window??? „400 ZŁ DO IKEA Z KARTĄ KREDYTOWĄ MASTERCARD IMPRESJA” promotion regulations (in Polish)

- ???link.opens.in.new.window??? „350 ZŁ DO IKEA Z KARTĄ KREDYTOWĄ MASTERCARD IMPRESJA” promotion regulations (in Polish)

- ???link.opens.in.new.window??? „400 zł z kartami kredytowymi Visa Impresja i Visa Global” promotion regulations (in Polish)

Credit cost and legal note

-

Credit cost and legal note

Representative example for Millennium Visa/Mastercard Impresja credit card: Annual Percentage Rate of Charge (APRC) is 18.28%; total loan amount (net of debt-financed costs): 6 700.00 PLN, total amount due: 7 418.10 PLN; variable interest rate 14.5%; total cost of the loan: 718.10 PLN (including: sum of monthly credit card fees 87.89 PLN; interest 630.21 PLN), with the assumption that the approved credit limit is used-up outright in the full amount as a non-cash transaction and is repaid in 12 equal monthly instalments of 618.10 PLN. The calculation was made as of 05/03/2026 on a representative example.

The organiser of the “Moneyback dla kart Impresja” Programme, which is active from 01.02.2026 till 30.09.2026 is Bank Millennium S.A. The Programme is targeted at holders of “Millennium Visa Impresja” and/or “Millennium Mastercard Impresja” cards issued under agreements: concluded till 11.11.2019 or from 30.04.2013, or to which after 28.11.2020 an annex was concluded amending provisions regarding rules on interest rate on the Card Account. Programme rules are contained in the “Moneyback dla kart Impresja” Programme Regulations, available on the website www.bankmillennium.pl.

Before granting a credit card the Bank evaluates the Applicant’s credit capacity and worthiness on a case-by-case basis; in justified cases it may refuse to grant the card. Fees, interest rate as well as other details are provided in the Price List - Credit Cards, Price List - BLIK Mobile Payments, Regulations on Credit Cards Issued by Bank Millennium SA, Regulations on “Moneyback dla kart Impresja” Programme, available in Millennium branches and on www.bankmillennium.pl. Offer details are also available in TeleMillennium by calling 801 331 331 (calls charged at operators’ tariffs).