07.12.2023

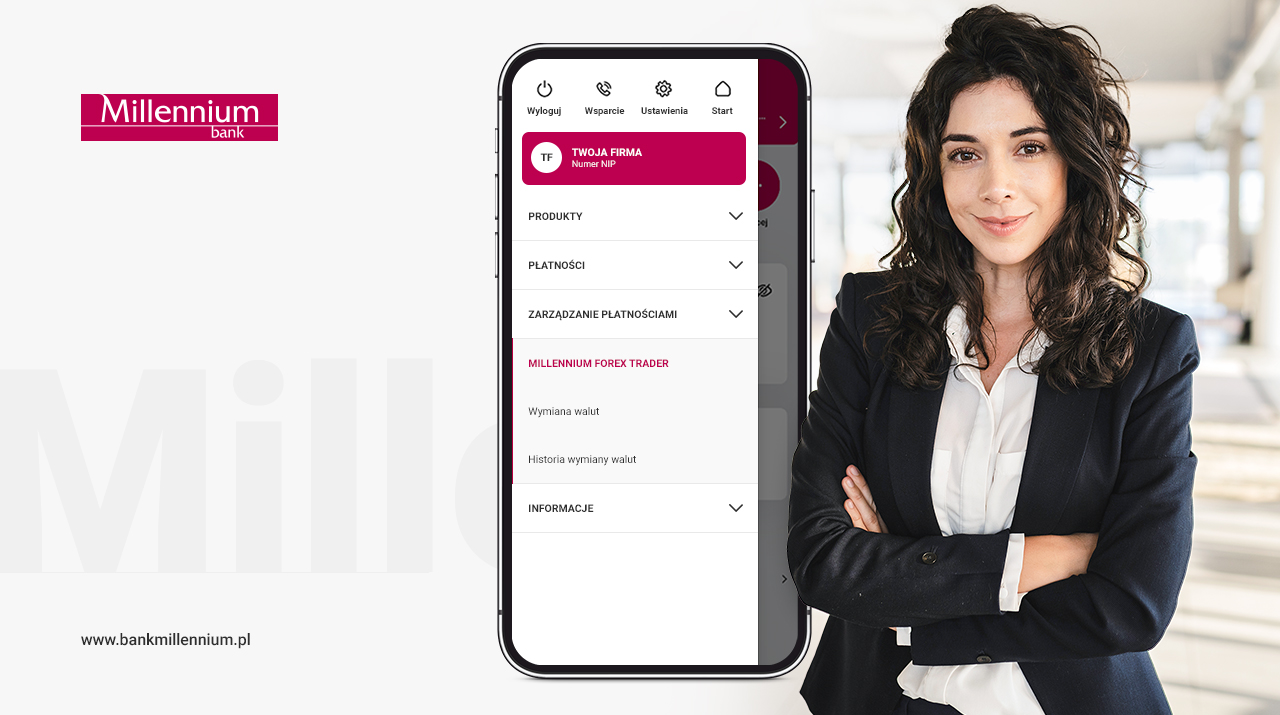

Millennium Forex Trader w aplikacji mobilnej dla firm

Nowa aplikacja mobilna dla firm Banku Millennium została poszerzona o Millennium Forex Trader – platformę transakcyjną, której użytkownicy mogą samodzielnie zawierać transakcje na rynku walutowym.

Millennium Forex Trader to zintegrowane, intuicyjne rozwiązanie, umożliwiające monitorowanie online bieżących poziomów cen dla wybranych par walutowych oraz zawieranie transakcji. W wersji na aplikację mobilną - kasowych i terminowych transakcji wymiany walutowej do jednego roku, w serwisie internetowym Millenet, dodatkowo transakcji swapa walutowego do 1 roku oraz zleceń warunkowych dot. kasowych transakcji wymiany walutowej. Transakcje zawierane są po bieżących kursach wymiany, pochodzących prosto z rynku walutowego. Dzięki wygodnemu i prostemu sposobowi rozliczania transakcji, są one widoczne na rachunku bankowym firmy, niezwłocznie po zawarciu.

- Dzięki platformie przedsiębiorcy mają bezpośredni dostęp do międzynarodowego rynku walutowego i mogą na bieżąco reagować na zmieniającą się sytuację kursową, samodzielnie sprzedając i kupując waluty na konkurencyjnych warunkach. Co ważne, mogą z niej korzystać firmy różnej wielkości, również małe, o relatywnie niewielkich obrotach. Millennium Forex Trader cieszy się dużym zainteresowaniem, aktualnie ponad 70% transakcji walutowych jest zawieranych poprzez platformę. Zawieranie transakcji online upraszcza i skraca czas operacji, umożliwia osiągnięcie pełnej kontroli nad ich przebiegiem, jak również nad pozycją walutową firmy oraz uzyskanie rynkowych cen transakcyjnych nawet dla niewielkich nominałów. To też oszczędność czasu i minimalizacja kosztów obsługi z uwagi na dostęp do kwotowań bezpośrednio z rynku międzybankowego. Podsumowując – internetowe platformy wymiany walut to niezwykle wygodne narzędzie dla przedsiębiorstw prowadzących aktywną wymianę handlową z zagranicznymi partnerami – mówi Marcin Serafin, dyrektor Departamentu Skarbu w Banku Millennium.

Każdy użytkownik, który ma dostęp do modułu Millennium Forex Trader w Millenecie dla Przedsiębiorstw, może jednocześnie korzystać z jego wersji w aplikacji mobilnej. Aplikacja umożliwia śledzenie zmian kursów dla wybranych par walutowych w okresie trwania sesji logowania. Zmiany prezentowane są na ekranie w postaci kolorowych wskaźników, obrazujących wzrost lub spadek kursu. Użytkownik aplikacji samodzielnie definiuje pary walutowe oraz domyślną datę waluty (rozliczenia transakcji), które będą widoczne po zalogowaniu do platformy.

Nowa aplikacja mobilna dla firm Banku Millennium została zbudowana od podstaw z wykorzystaniem najlepszych praktyk, stosowanych przez bank przy tworzeniu rozwiązań dla klientów detalicznych. Stworzono przyjazną, unikalną pod kątem jakości aplikację, gotową do obsługi dużych ilości danych, skierowaną zarówno do właścicieli niewielkich firm, jak i dużych korporacji z rozbudowanymi działami finansowymi. Trafiła ona do sklepów w maju br. i w zaledwie pół roku zyskała 10 tys. użytkowników firmowych.

– Klienci bardzo pozytywnie przyjęli nową aplikację, o czym świadczą jej wyniki. Już co trzecia firma korzystająca z Millenetu dla Przedsiębiorstw ma aplikację. I ta liczba każdego dnia rośnieM – mówi Paweł Idzikowski, kierujący zespołem produktów bankowości przedsiębiorstw w Departamencie Bankowości Elektronicznej. – Najbardziej cieszy nas to, że aż 90% klientów loguje się do aplikacji i aktywnie z niej korzysta. To ogromny sukces – dodaje.

Od momentu udostępnienia aplikacja jest stale rozwijana. Dziś umożliwia m.in. logowanie odciskiem palca lub skanem twarzy, zarządzenie jednocześnie wieloma kontami, w jednym panelu, elastyczne nadawanie uprawnień dla użytkowników, dodawanie kolejnych firm klientów i szybkie przełączanie się pomiędzy nimi oraz ich produktami, bez potrzeby przelogowania. Użytkownik może personalizować aplikację według swoich potrzeb.

Aplikacja bardzo usprawnia zlecenie codziennych płatności firmy. Informuje użytkownika o zdarzeniach na rachunku m. in. wpływach na rachunek, blokadach, płatnościach oczekujących na autoryzację. Prosty interfejs skraca czas realizacji operacji. Kontrahentów można od razu sprawdzić na białej liście podatników VAT. Dodatkowo, w łatwy sposób można wygenerować w aplikacji potwierdzenia i wyciągi, które można wysłać e-mailem czy za pośrednictwem komunikatora w telefonie.. Zarządzanie płatnościami jest proste, użytkownik może szybko i bezpiecznie autoryzować płatności. Na ekranie głównym znajdują się dwa kafle – autoryzacja i przelewy odrzucone, które pozwalają od razu obsłużyć te operacje. Płatności, które czekają na autoryzację, użytkownik może zaznaczyć i potwierdzić jednym kliknięciem. Jedno kliknięcie wystarczy również, żeby zaakceptować całą paczkę zleceń. Aplikacja zapewnia też bezpieczeństwo użytkowników podczas autoryzacji zleceń, co jest szczególnie istotne dla dużych przedsiębiorstw, w przypadku wielopoziomowych struktur akceptacji transakcji. Użytkownik widzi pełną historię zleceń, kto je wprowadził, zmodyfikował i autoryzował.

Więcej o aplikacji na https://www.bankmillennium.pl/przedsiebiorstwa/bankowosc-elektroniczna