28.03.2022

Doradztwo inwestycyjne w Banku Millennium

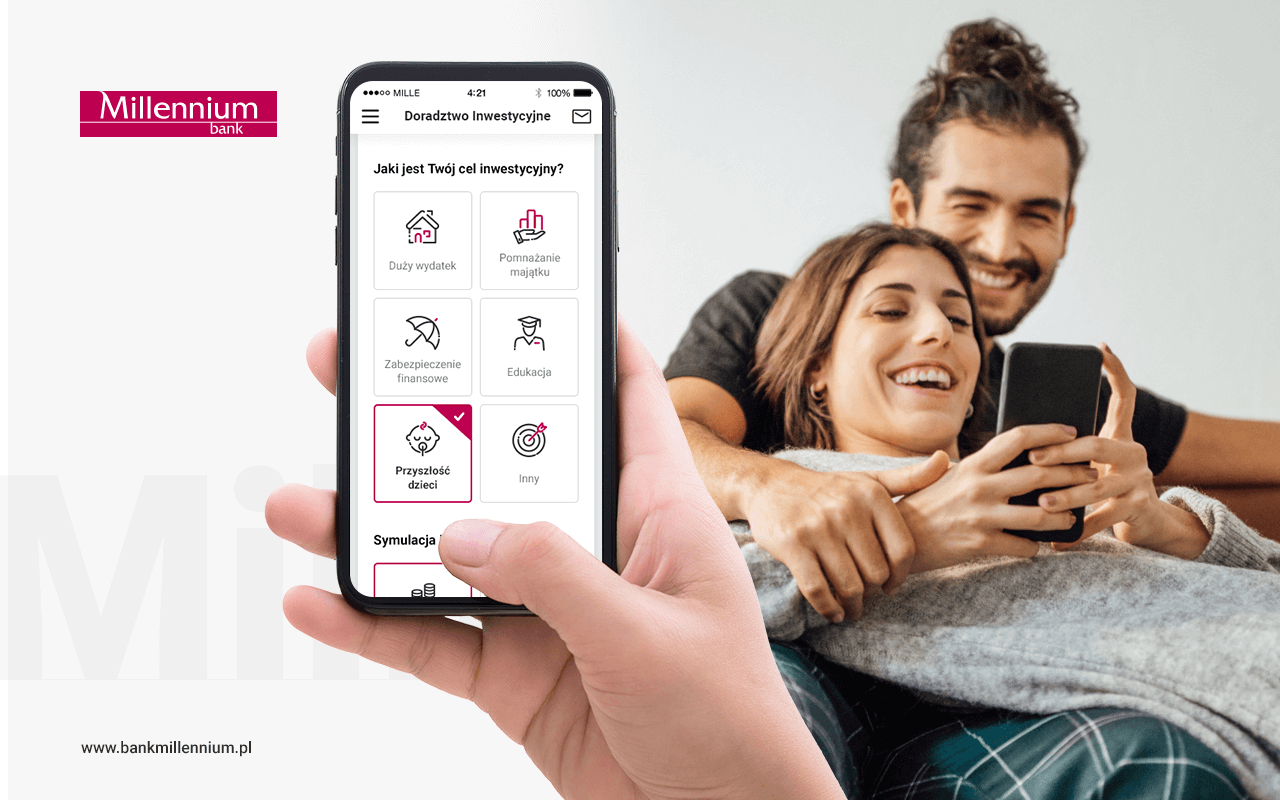

Bank Millennium udostępnił w serwisie internetowym Millenet, aplikacji mobilnej oraz w swoich placówkach usługę doradztwa inwestycyjnego. Po tym jak klient uzupełni ankietę oraz określi m.in. swoje cele inwestycyjne oraz horyzont czasowy ich realizacji, bank z wykorzystaniem specjalnego algorytmu będzie mógł zarekomendować mu najlepiej dopasowany do jego potrzeb fundusz inwestycyjny, spośród oferty funduszy dostępnych w ramach usługi. Klient może skorzystać z rekomendacji i zacząć swoją przygodę z inwestowaniem już od kwoty 200 zł. Usługa ma na celu uczynić ten sposób lokowania oszczędności bardziej przystępnym dla każdego.

- Obecnie niewielu klientów banków w Polsce decyduje się na inwestycje. Chcemy rozszerzyć dostępność tego obszaru dla jak największej grupy klientów. Dlatego wprowadziliśmy w pełni zautomatyzowaną usługę, skierowaną m.in. do osób, które nie inwestują, nie wiedzą jak zacząć lub po prostu nie mają czasu na śledzenie wydarzeń ekonomicznych – mówi Tomasz Brzostowski, kierownik Wydziału Sprzedaży w Kanałach Elektronicznych w Banku Millennium.

W ramach usługi doradztwa inwestycyjnego na podstawie odpowiedzi na szczegółowe pytania dotyczące m.in. celów inwestycyjnych, sytuacji finansowej oraz potrzeb danego klienta wydawana jest rekomendacja inwestycyjna. - To znacznie ułatwia proces decyzyjny. Klient nie musi samodzielnie szukać i porównywać dostępnych produktów – dodaje Tomasz Brzostowski.

Dodatkowo w systemie banku prezentowana jest symulacja oparta na historycznych wynikach rekomendowanego funduszu inwestycyjnego w trzech scenariuszach: pozytywnym, negatywnym i neutralnym. Ta informacja obrazuje klientowi, ile jego inwestycja warta byłaby dziś, gdyby kilka lat temu zainwestował w rekomendowany fundusz i pozwala tym samym przygotować się na różne scenariusze rozwoju sytuacji na rynkach finansowych.

By inwestowanie uczynić dostępnym dla każdego, oferta Banku Millennium dostępna w ramach usługi charakteryzuje się niskim progiem wpłat, wystarczy 200 zł. Ponadto bank wprowadził możliwość łatwego zarządzania inwestycją, w tym ustanowienie zlecenia stałego, dzięki czemu wskazana kwota będzie automatycznie wpłacana na konto wybranego produktu inwestycyjnego, co ułatwia regularne inwestowanie. Klient może skorzystać z rekomendacji i złożyć zlecenie nabycia wskazanego produktu za pośrednictwem kanałów elektronicznych. Może też zmienić parametry celu i otrzymać nową rekomendację.

Pozostałe zalety usługi doradztwa inwestycyjnego:

- w pełni zautomatyzowany, składający się z kilku prostych kroków i przejrzysty proces dostępny w kanałach zdalnych;

- nie wymaga zaawansowanej znajomości produktów inwestycyjnych i rozległej wiedzy na temat inwestowania;

- możliwość utworzenia wielu różnych celów inwestycyjnych, dla każdego z nich klient definiuje swoją własną nazwę i określa okres inwestycji;

- po wypełnieniu ankiety i zawarciu z bankiem umowy klient może otrzymać rekomendację nabycia jednego z funduszy Millennium TFI dostępnych w ramach usługi doradztwa inwestycyjnego. Rekomendacja wydawana jest odrębnie dla każdego celu;

- swoje cele klient może monitorować w systemie internetowym Millenet i w aplikacji mobilnej, ma też stały dostęp do swoich środków – a w ramach usługi przyjmowania i przekazywania zleceń może składać zlecenia zamiany lub odkupienia części lub całości inwestycji;

- usługa jest darmowa, klient nie ponosi kosztów za wydanie rekomendacji, czy złożenie zlecenia zgodnie z wydaną rekomendacją ani też za realizację zleceń stałych w ramach usługi przyjmowania i przekazywania zleceń ;

- usługa została przygotowana przez wykwalifikowanych ekspertów i jest na bieżąco przez nich monitorowana.

Bank planuje wkrótce wprowadzić również monitoring celów klienta polegający na tym, że w określonych przypadkach wydawana będzie aktualizacja rekomendacji, tym samym klient będzie posiadał wsparcie doradcze nie tylko na starcie ale przez cały okres trwania inwestycji.

Nota prawna:

Wszelkie informacje zawarte w niniejszej PUBLIKACJI HANDLOWEJ mają wyłącznie charakter informacyjny i nie stanowią ani oferty w rozumieniu Ustawy z dnia 23 kwietnia 1964 r. Kodeks cywilny, ani rekomendacji, ani też kierowanego do kogokolwiek (lub jakiejkolwiek grupy osób) zaproszenia do zawarcia transakcji na instrumentach finansowych w niej przedstawionych.

Szczegółowe informacje dotyczące usługi doradztwa inwestycyjnego oraz jej modelu i warunków jej świadczenia zamieszczone są w Regulaminie usługi doradztwa inwestycyjnego.

Rekomendacja inwestycyjna nie stanowi gwarancji osiągnięcia założonego celu, ani uzyskania określonego wyniku inwestycyjnego. Fundusze nie gwarantują realizacji założonego celu inwestycyjnego, ani uzyskania określonego wyniku inwestycyjnego. Bank nie ponosi odpowiedzialności za decyzje klientów związane z inwestowaniem w fundusze inwestycyjne zarządzane przez Millennium Towarzystwo Funduszy Inwestycyjnych S.A., w stosunku do których Bank wydaje rekomendacje inwestycyjne. Decyzje o zainwestowaniu w dany fundusz inwestycyjny, nawet po uzyskaniu Rekomendacji od Banku, Klient zawsze podejmuje samodzielnie. Każda decyzja inwestycyjna powinna zostać podjęta przez klienta na podstawie informacji zawartych w prospektach informacyjnych i Kluczowych Informacjach dla Inwestorów (KIID), raporcie Ex-Ante oraz w „Opisie ryzyka związanego z instrumentami i produktami finansowymi dla osób fizycznych w Banku Millennium S.A.”

Rozpowszechnianie i dystrybucja niektórych instrumentów lub produktów finansowych oraz obrót nimi mogą być przedmiotem ograniczeń w odniesieniu do pewnych osób i państw, zgodnie z właściwym prawodawstwem. Oferowanie instrumentów finansowych oraz obrót nimi mogą być dokonywane jedynie przy zachowaniu zgodności z właściwymi przepisami prawa.

Środki zainwestowane w fundusze inwestycyjne Millennium nie są objęte systemem gwarantowania Bankowego Funduszu Gwarancyjnego, zgodnie z ustawą o Bankowym Funduszu Gwarancyjnym, systemie gwarantowania depozytów oraz przymusowej restrukturyzacji z dnia 10 czerwca 2016.

Na etapie wyboru jednostek uczestnictwa danego subfunduszu, mając na względzie odpowiedzi udzielone przez Klienta w Ankiecie inwestycyjnej Bank każdorazowo przekazuje informację, czy subfundusz jest zgodny z jego cechami, celami i potrzebami. W przypadku niezgodności lub częściowej niezgodności produktu z cechami, celami i potrzebami Klienta, Bank przekazuje stosowne ostrzeżenie i nie rekomenduje klientowi nabycia danego subfunduszu.

Szczegóły dotyczące opłat dostępne są w Tabeli opłat Millennium TFI,. Wszelkie informacje i dokumenty wymienione powyżej dostępne są na stronie internetowej Banku www.bankmillennium.pl w sekcjach MiFID oraz Doradztwo inwestycyjne.