27.10.2017

Czy Polacy czują się finansowo bezpieczni?

Ponad jedna trzecia Polaków nie ma żadnych oszczędności, a ponad połowa nie ma poczucia finansowego bezpieczeństwa – wynika z badania przeprowadzonego na zlecenie Banku Millennium z okazji Światowego Dnia Oszczędzania. Jak wysokie powinniśmy mieć oszczędności, by czuć się finansowo zabezpieczeni? Czy na poczucie finansowego bezpieczeństwa ma wpływ otrzymywane świadczenie 500+?

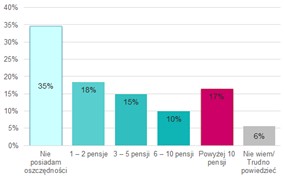

65% Polaków deklaruje, że posiada oszczędności. 18% badanych ocenia ich wysokość na poziomie 1-2 swoich pensji, 15% na 3-5 pensji, 10% na 6-10 pensji, a 17% powyżej 10 pensji. Co ciekawe, w najmłodszej grupie respondentów (18-29 lat) odsetek osób posiadających oszczędności wynosi aż 71%.

Wykres 1. Oszczędności Polaków. Równowartość ilu pensji stanowią oszczędności?

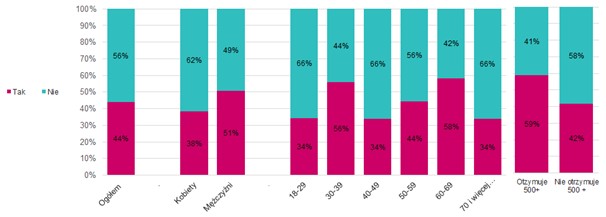

Deklarowane oszczędności nie przekładają się na poczucie finansowego bezpieczeństwa. Tylko 44% respondentów czuje się generalnie zabezpieczona finansowo. Widać też wyraźną różnicę miedzy kobietami, a mężczyznami - 51% mężczyzn i tylko 38% kobiet ma poczucie finansowego bezpieczeństwa. Z badania wynika też, że nie rośnie ono wraz z wiekiem, jest natomiast zdecydowanie większe wśród osób otrzymujących świadczenie 500+.

Wykres 2. Poczucie bezpieczeństwa finansowego. Czy czuje się Pan(i) generalnie zabezpieczony finansowo

Na pytanie, jaki poziom oszczędności powinniśmy posiadać, by czuć się finansowo zabezpieczeni, aż 52% badanych odpowiedziało, że powinno to być ponad 10 pensji. Niestety takie oszczędności deklaruje jedynie 17% respondentów.

- Na wysokość zgromadzonych oszczędności mają wpływ czas i systematyczność oszczędzania. Od wielu lat przekonujemy naszych klientów, że ważne jest oszczędzanie choćby niewielkich kwot, a najlepsze efekty przynosi oszczędzanie długoterminowe. Podkreślamy, że kluczem do sukcesu w oszczędzaniu są samokontrola i konsekwencja – mówi Robert Chorzępa, Kierujący Wydziałem Produktów Oszczędnościowych w Banku Millennium. - Rozmawiając z klientami widzimy też, że potrzeba posiadania oszczędności czy zabezpieczenia finansowego wynika bardziej z nastawienia i poziomu finansowej świadomości danej osoby niż z zasobności jej portfela.

Klienci, którzy chcą oszczędzać, mają do wyboru wiele produktów oszczędnościowych i inwestycyjnych. Dużą popularnością cieszy się niezmiennie konto oszczędnościowe, które pozwala na wygodne gromadzenie oszczędności dzięki możliwości wpłat w dowolnej wysokości i w każdym momencie. Konto daje też swobodny dostęp do zgromadzonych oszczędności bez utraty odsetek. Dodatkowo dzięki aplikacji mobilnej i serwisowi bankowości internetowej, obsługa konta oszczędnościowego jest możliwa z każdego miejsca, 24 godziny na dobę.

W ramach aktualnie trwającej promocji, posiadacze Konta Oszczędnościowego Profit Banku Millennium mogą zyskać 2,5% w skali roku przez 3 miesiące dla nowych środków do 100 000 zł. Promocyjne oprocentowanie dla nadwyżki ponad 100 tys. zł wynosi 1,7% w skali roku przez trzy miesiące. Promocja trwa do 13 stycznia 2018 r. Więcej informacji na www.bankmillennium.pl/klienci-indywidualni/produkty-oszczednosciowe/rachunki-oszczednosciowe/konto-oszczednosciowe-profit

Metryka cytowanego badania: badania zostały przeprowadzone przez Instytut Badań Rynkowych i Społecznych IBRiS w dniach 24–25 sierpnia 2017 r. na reprezentatywnej, 1100-osobowej, ogólnopolskiej próbie pełnoletnich Polaków. Technika badawcza: CATI.