Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

Update the browserWhat you gain

Choose Mortgage Loan on attractive terms (APR 7.33%):

- 0% commission for loan granting and earlier repayment (APR 7.33%)

- interest rate lower by up to 0.6 p.p. compared to the price list if you meet additional conditions

- credit holidays once a year

- check the status of your application in the mobile app even if you do not have an account in Bank Millennium

- support of our credit specialists on every stage

Is your property energy efficient? An EKO mortgage is for you

EKO mortgage

Instalment fixed for 5 years

Consider a loan with fixed interest rate:

- your instalment will not change for 5 years

- after 5 years you can choose a fixed interest rate for the next 5 years. If you do not, the interest rate will again be variable

- if you have a mortgage in PLN with variable interest rate you can apply for changing it to fixed interest rate

INFORMATION

From 1 March 2023 we have suspended the offer of mortgage loans with variable interest rate options for the entire life of the loan.

Mortgage loans with a periodically fixed interest rate for the first 5 years remain in our offer.

Mortgage Calculator

We have made the calculation based on the data you entered into the calculator. It contains approximate and sample calculations as of the date on which we made it. It is for informational purposes only. Do not treat it as an offer, recommendation, invitation to conclude a mortgage agreement or advisory service. The instalment is calculated on the assumption that you will repay the mortgage in equal instalments. You can also apply for a mortgage with decreasing instalments. The final instalment amount will depend on a full assessment of your creditworthiness. To obtain a mortgage, you must also meet other necessary conditions.

A fixed interest rate is a fixed interest rate for 60 months from the date of mortgage disbursement. After this period, the interest rate on the mortgage will be variable and will consist of a margin and the WIBOR 6M reference rate. We can also agree on a new fixed interest rate for the next 60 months and sign an annex to the mortgage agreement. During the fixed interest rate period, you cannot change it to a variable rate. If, during the variable interest rate period, the WIBOR 6M reference rate applicable in a given interest period is zero or negative, the interest rate on your mortgage during that interest period will be equal to the bank's margin.

The Annual Percentage Rate (APR) for a mortgage mortgage with selected parameters is {rrso}. We calculated it on the assumption that after 60 months of a fixed interest rate, the mortgage interest rate will be the same as at the time of calculating the APR based on the agreed reference rate applicable at that time, but not lower than the fixed interest rate. it will remain the same as at the time of calculating the APR based on the reference rate applicable at that time, but will not be lower than the fixed interest rate.

The Annual Percentage Rate (APR) assuming that after the end of the first 60-month period of the fixed interest rate, you will repay the entire mortgage is {rrso5years}. If the mortgage calculator shows an offer with a reduction in interest rates for using additional financial products or services, we have assumed that you will meet the conditions for maintaining this reduction. You do not have to choose additional financial products or services; you can choose just the mortgage. The use of additional products and services is not a condition for obtaining a mortgage, but it does affect its pricing terms. Before we grant you a mortgage, we will assess your creditworthiness and credibility. In justified cases, we may refuse to grant you a mortgage.

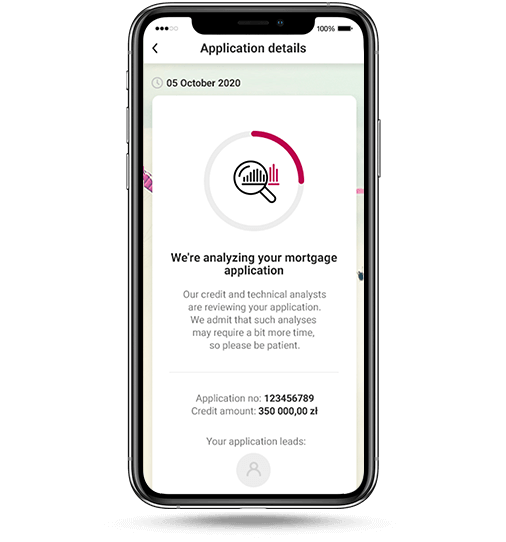

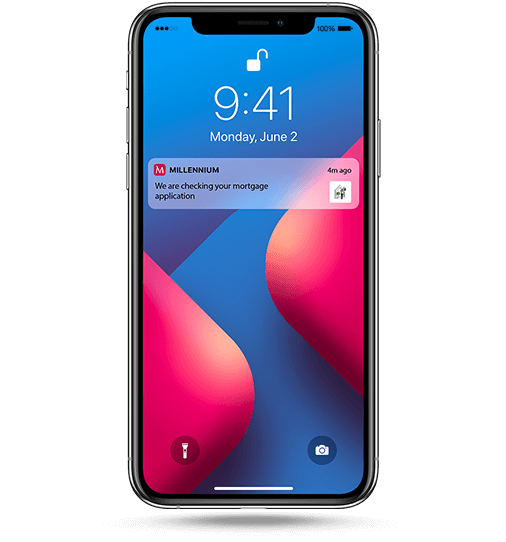

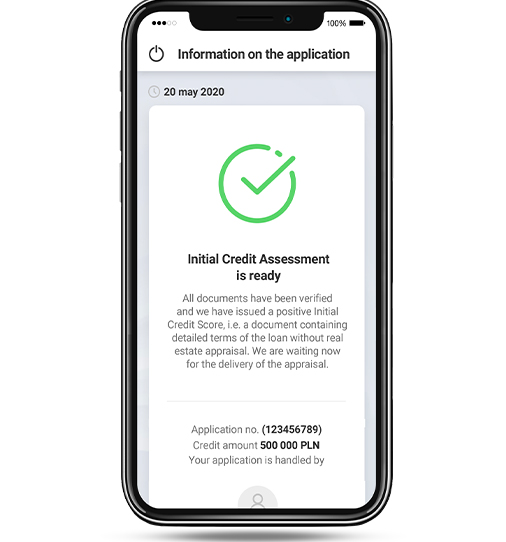

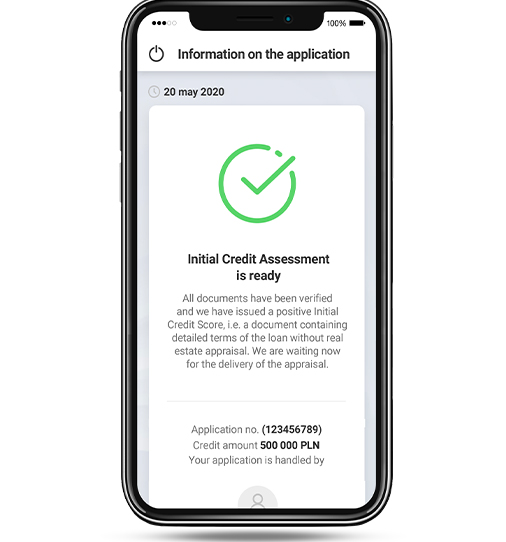

Check your application status online

You can track your mortgage application progress in Millenet and mobile app:

-

You can see on what stage your application is and what happens with it

-

You get a message when the status of your application changes

-

You know what your next steps are

-

1

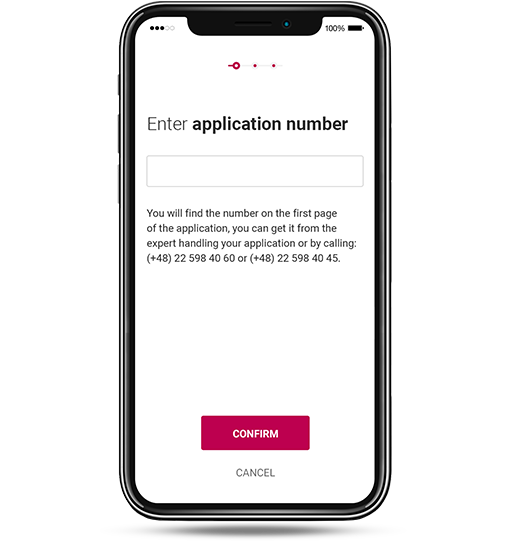

Download the mobile app to your mobile device and select mortgage application status at the bottom of the screen

-

2

Provide data, e.g. application number and data from your identifier (e.g. PESEL)

-

3

Done! Now you can check what is happening with your application

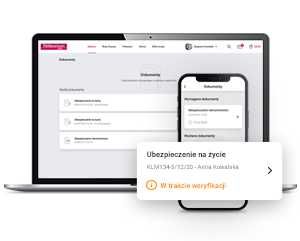

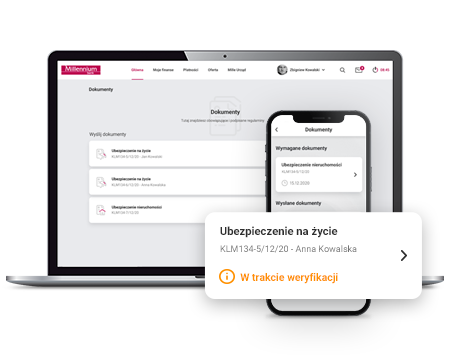

You can conveniently attach

your insurance documents

If you choose real estate insurance or life insurance required to secure a loan with another institution, you can attach all documents easily and quickly online:

- you can add real estate and life insurance documents in the app and Millenet

- we will remind you about the upcoming deadline

- we will inform you about the result of the documents verification

- if there is a need to add documents again, you will also do it after the policy expiry date conveniently via Millenet or the mobile app

Borrowers’ Support Fund

The fund was set up to help out people in a difficult financial situation who make mortgage repayments.

FAQ

-

What can I use a mortgage loan for?

You can use a mortgage loan (or simply mortgage) to finance the purchase of a house or a flat on the primary or secondary market, construction or extension of a house, refurbishment or modernisation. A loan from another bank can also be refinanced.

-

What is borrowing capacity and how can it be calculated?

Borrowing capacity determines your ability to repay a loan you have taken out with interest on time. You can use the mortgage calculator to estimate your borrowing capacity. Thanks to the calculator you will also check, on an estimate basis, what loan instalment you can expect.

Your borrowing capacity will be calculated by the Bank based on your loan application.

-

Am I entitled to a refund of the increased risk commission until the mortgage has been established?

Yes, if the mortgage agreement has been concluded (signed) by 16 September 2022 and the court enters the mortgage on or after 17 September 2022, we will refund you the entire commission charged.

When do I get my commission refunded?

Once the court has registered the mortgage in the land registry and we have verified and confirmed that the entry meets the conditions specified in the loan agreement, we will refund the commission. You will receive the commission within 60 days of the mortgage being registered.How do I receive my commission back?

We refund the commission to the account from which it was taken.Do I need to apply for a commission refund?

Do I need to apply for a commission refund?Legal basis for the reimbursement of commissions

"Act of 5 August 2022 amending the Mortgage Credit Act and the Supervision of Mortgage Credit Intermediaries and Agents and the Act amending the Personal Income Tax Act, the Corporate Income Tax Act and certain other acts". -

Can I repay the loan earlier?

Yes. You can partially or fully repay a loan with no additional cost to you. You will conveniently make the partial repayment in Millenet, fully repayment is possible in our branch.

- Hide Show more

Additional information

List of required documents

-

- Application for information about the loan

- Documents confirming your identity (ID or passport)

-

1. Value estimate of the property

To make a credit decision, we will need a value estimate of the flat/house prepared by a property valuation expert.

If you do not have an appraisal report, you can use the Bank's support in obtaining it. You just need to:

- order the appraisal report when submitting the loan application (or at a later stage) and choose one of the two nationwide suppliers cooperating with the Bank

- you will pay the report by bank transfer directly to the supplier's account (the Bank does not charge any fees for assistance in ordering the report)

- in just a few minutes, your order and the required documents will be delivered to an expert

- for your safety, the appraiser may conduct an on-line inspection without a physical visit to the flat/house

- you will receive the report even within 3-4 days (from the moment of inspection) in electronic and/or paper form

- at the same time, the report will be made available to the Bank, which will shorten the time to issue a credit decision

Current price list of suppliers cooperating with the Bank:

- 499 PLN a flat, garage, undeveloped land

- 799 PLN single-family residential building, semi-detached house, residential unit in a terraced or semi-detached building

You can also provide us with your appraisal report made by an authorized property appraiser. Check the Central Register of Property Appraiserslink opens in a new card.

2. Copy of the entry in the land and mortgage registry - applies to real estate securing the loan

Additionally, if the loan is secured by a single-family home or by an undeveloped plot of land, the following may be required:

- final occupancy permit, or – if the former is not required by law – certificate of the completion of the construction along with the information on the lack of objection lodged certified by relevant authorities, or the decision on the amount of real-estate tax

- copy of the entry in land registry or copy of the survey map

- certificate of copy from the entry in the local spatial development plan confirming real estate use classification

-

- Employment and income certificate Download File PDF opens in a new card

- Employment and income certificate (English version) Download File PDF opens in a new card

- Extracts from the current account for the period of the last 3 months

How can you lower

your interest rate

-

You can reduce your mortgage interest rate by up to 0.6 percentage points (p.p) if you meet all the conditions described below:

- you have or open a personal account with our bank

- your salary or other net income is transferred to your personal account in Millennium every month

- you spend PLN 500 each month using a debit card assigned to this account

- you take advantage of Życie pod ochroną insurance through us

Życie pod ochroną is a voluntary individual insurance with insurance cover provided by Towarzystwo Ubezpieczeń na Życie Europa S.A. Bank Millennium is an insurance agent, which acts on behalf of TU na Życie Europa S.A. and through it you can conclude the insurance contract. Detailed information is described in the General Terms and Conditions of Insurance and the Product Card, which you can find hereplik PDF otwiera się w nowej karcie.

You will maintain a reduced interest rate of up to 0.6 p.p. until the end of the loan period if you meet all the conditions described below:

- in each of the following 55 calendar months after the month in which we disburse the loan, your salary or other net income is transferred to your personal account with our bank

- in each of the following 55 calendar months after the month in which we disburse the credit, you spend 500 by paying with a debit card assigned to this account

- you maintain Życie pod ochroną insurance for 36 consecutive calendar months after the month in which we disburse the credit

If the mortgage has been granted to more than one borrower, Życie pod ochroną must be used for 36 months by all of them, who are required to provide security for the repay Życie pod ochroną contract.

You maintain your right to the discount even if you do not meet the conditions of paying with a debit card and receiving salary into the account in any 5 calendar months.

-

You can reduce your interest rate by up to 0.4 percentage points (p.p.) if you meet all the conditions described below:

- you have or open a personal account with our bank

- your salary or other net income is transferred to your personal account in Millennium every month

- you spend PLN 500 each month using a debit card assigned to this account

You will maintain a reduced interest rate of up to 0.4 p.p. until the end of the loan period if you fulfil all the conditions described below in total:

- in each of the following 55 calendar months after the month in which we disburse the loan, your salary or other net income is transferred to your personal account with our bank

- in each of the following 55 calendar months after the month in which we disburse the credit, you spend 500 by paying with a debit card assigned to this account

You maintain your right to the discount even if you do not meet the conditions of paying with a debit card and receiving salary into the account in any 5 calendar months.

-

You can reduce the interest rate by 0.2 percentage points (p.p.), and keep the reduction until the end of the loan period, if in each of the following 55 calendar months calendar months after the month in which we disburse the loan you fulfil all the conditions described below:

- you have or open a personal account with our bank

- you spend PLN 500 each month paying with a debit card to this account

You maintain your right to the discount even if you do not meet the conditions of paying with a debit card and receiving salary into the account in any 5 calendar months.

Fixed or variable interest rate

-

If you value peace of mind and want to be sure that your mortgage loan payment will not change during the next 5 years, consider the fixed rate loan. A fixed interest rate is available for mortgage loans in PLN.

- Selecting a loan with a fixed interest rate you have 30 days to accept the credit decision and to sign the agreement.

- During the first 5-year period of validity of the fixed rate (during 60 months starting from the day of loan disbursement) you cannot switch over to a variable interest rate.

- After this period os over you can decide to have another 5-year period of fixed interest rate or to switch over to variable interest rate, which is the sum of the bank’s margin and the WIBOR 6M reference rate.

- If you choose another period, we will give you a proposal of the fixed interest rate for the next 5 years.

- If you do not accept the new fixed interest rate, after this period your loan will be subject to variable interest rate and your monthly payments will depend on WIBOR and the margin defined in the loan agreement.

- If you accept the terms and sign the annex to the loan agreement, you will be able to enjoy the fixed rate with the new terms during the next 5 years.

- If you already have a loan in PLN with variable interest rate, you can apply for change to a fixed interest rate, valid during 5 years.

If periodically fixed interest rate is used, it will remain valid for 5 years. During this period the monthly principal-interest payment of your loan will not change, because it does not depend on change of the benchmark. There is the risk however, that during the fixed interest rate period your monthly payment may be temporarily higher than if it were calculated on the basis of the current WIBOR 6M reference rate, used as the benchmark in calculating variable interest rate. After the a/m 5-year period you can choose to apply periodically fixed interest rate (note: it ,may differ from the interest rate in the previous period) for another 5-year period (it will be the same in case of subsequent periods) or to apply a variable interest rate.

Meanwhile during the period when variable interest rate is applied there is the risk of change of interest rates. The risk of change of interest rates means that in case of increase of the level of WIBOR 6M reference rate the interest rate on the loan will be higher; then the amount of the monthly principal-interest instalment increases and this in turn will cause an increase of the cost of interest and thus increase of total cost of the mortgage loan. If the reference rate is zero or negative, the interest rate on the loan during this period shall be equal to the Bank’s margin.

-

What do you need to do to settle a new fixed interest rate for the next period?

If you have a loan with a periodically fixed interest rate and you want to agree with us on a new fixed interest rate for the next 60 months, please submit an application no later than 30 days before the end of the current fixed interest rate period. You can submit your application at any of our branches.

Agreeing on a new fixed interest rate for the next period requires an annex to the agreement.

When can you submit your application?

We will remind you when you can submit your application for a new interest rate before the current fixed interest rate period expires. We will send you a text message and a letter.

How do we determine the new fixed interest rate?

We determine the new fixed interest rate for the next 60 months in accordance with the price list valid on the date you submit your application. The current price listlink opens in new window is available on our website.

In order for us to enter the new fixed interest rate for the next 60 months into the agreement, we need to sign an annex to the agreement with you. The annex is free of charge.

What if we do not agree on a new fixed interest rate?

If you do not submit an application or we do not agree on a new fixed interest rate for the next 60 months, your loan will bear interest at a variable interest rate, which is the sum of the bank's margin and the reference rate specified in your mortgage loan agreement.

-

You can change the interest rate on your loan or mortgage to a periodic fixed rate for 5 years. After this time, your loan will automatically revert to a variable interest rate based on WIBOR. You can also reapply to change to a periodic fixed rate on new terms for another 5 years.

How to do it?

- You apply to change the interest rate on your mortgage or loan at any bank branch.

- You apply to change the interest rate on your mortgage or loan at any bank branch.

- You sign an annex to the contract. The cost of the annex is 200 PLN.

- Remember that the application and the annex must be signed by all borrowers.

You can change the interest rate method if:

- your credit is in PLN,

- you are creditworthy and pay your instalments on time,

- you have no less than 5 years left to the end of the loan term (from the date of signing the interest rate adjustment annex).

-

From 1 March 2023 we have suspended the offer of mortgage loans with variable interest rate options for the entire life of the loan.

Mortgage loans with a periodically fixed interest rate for the first 5 years remain in our offer.

About life insurance

-

The insurance covers your life and health. The insurer provides cover for the following events:

- death

- total inability to work and live independently

- a medical event entitling you to a second medical opinion

Życie pod ochroną is a voluntary individual insurance with cover provided by Towarzystwo Ubezpieczeń na Życie Europa S.A. Bank Millennium is an insurance agent, which acts on behalf of TU na Życie Europa S.A. and through it you can conclude an agreement for this insurance. Detailed information is described in the General Terms and Conditions of Insurance and the Product Card, which you can find hereplik PDF otwiera się w nowej karcie.

Collateral

-

For a mortgage collateral is:

- mortgage on residential property entered in the first place in favour of Bank Millennium

- assignment of rights from the insurance policy against fire and other accidents

- against fire and other accidents life insurance policy with the Bank as the only beneficiary

The target loan collateral may be also a mortgage on the property other than that financed with the loan, owned by you or a third party.

Credit cost

and legal note

-

APR for a periodically fixed interest rate

The Annual Percentage Rate (APR) for a mortgage loan with a periodically fixed interest rate is 7.33% and we calculated it with the following assumptions: the total amount of the mortgage loan (excluding borrowed costs) is 549 738 PLN, loan period 27 years, loan instalment 3 505,47 PLN, number of instalments 325, interest rate in the first 60-month period of the fixed rate 6,23%, %, and in the further loan period a variable interest rate of 6,68% (the sum of a fixed margin of 2.10% and the WIBOR 6M reference rate, which as of 30.09.2025 is 4.58%), loan secured by a mortgage on a newly acquired property with a value of 876 775 PLN. The margin is 2.10%, assuming that for 55 calendar months after the month in which we pay out the loan, you have a Millennium 360° account, this account is credited with your salary or other net income every month and you make non-cash transactions with the debit card to this account for the amount of min. 500 PLN per month and for 36 calendar months after the month in which we pay out the loan, you will remain a party to the life insurance agreement called ”Life under protection”, concluded through us (we act as an insurance agent of Towarzystwo Ubezpieczeń na Życie Europa S.A.). The total cost of the mortgage loan is 688 778,54 PLN. This amount includes commission for granting the loan 0 PLN, interest 625 788,38 PLN, real estate insurance against fire and other fortuitous events 21 450 PLN (available through us), life insurance 41 321,16 PLN (available through us), PCC tax 19 PLN and the court fee for establishing a mortgage 200 PLN. Account maintenance cost is 0 PLN. The fee for service of the debit card or BLIK contactless payments is 0 PLN, if in the previous month you pay at least once with the card or by BLIK, if you are aged 18-26 or 5 times, if you are aged over 26. Total amount due is 1 238 516,54 PLN. We made the calculations on 30.10.2025 on a representative example, assuming that you meet the conditions to maintain a reduced interest rate.

In the case of a mortgage loan with a periodically fixed interest rate, there is a risk that during the period of application of the fixed interest rate, your instalment may be higher than if it were calculated on the basis of the current WIBOR 6M reference rate, which is used in the calculation of the variable interest rate. After changing the interest rate on your loan to variable, an increase in the benchmark during the period of the fixed interest rate may cause a significant increase in the principal and interest instalment and thus the total cost of your loan. Furthermore, during the period when variable interest rate is applied there is the risk of increase of interest rate. Its amount depends on the WIBOR 6M benchmark. If the benchmark increases, the interest rate on your loan will be higher and the monthly principal and interest instalment will increase. Then the total cost of the loan will also increase. If the benchmark applicable in a given interest period is zero or negative, the interest rate on your loan in that interest period will be equal to the margin.

-

Detailed terms and conditions under which we grant mortgage loans are described in the Regulations on Lending to Individuals in Mortgage Banking at Bank Millennium S.A. Fees and commissions that we charge, as well as the interest rate are indicated in the Price List of Mortgage Loan / Home Equity Loan. You can consult these documents in our outlets and on the www.bankmillennium.pl website. Before we grant you a loan, we assess your credit capacity and creditworthiness each time. In justified cases, we may refuse to grant you credit. As collateral for the loan, you can present property insurance or life insurance outside the offer available through us. Such an insurance contract should be concluded with an insurer that is on the list published by the Polish Financial Supervision Authority.

You can take advantage of an additional offer, which consists in reducing the interest rate if all borrowers obliged to establish loan security in the form of assignment of rights under the life insurance contract conclude a ”Life under protection” insurance agreement through us. When offering this insurance, we act as an insurance agent of Towarzystwo Ubezpieczeń na Życie Europa S.A. Using the ”Life under protection” insurance is not necessary to obtain a mortgage loan, but it does affect its pricing. The conditions that you must meet to maintain the reduction throughout the loan period can be found in the document General information on the mortgage agreement. Detailed rules for providing insurance cover, including information on the exclusions of the insurer’s liability, are described in the General Terms and Conditions of Insurance. A summary of the most important features of this insurance can be found in the Product Card – ”Life under Protection” Insurance. These documents are available in our branches and on the www.bankmillennium.pl website.

Bank Millennium S.A. with its registered office in Warsaw, ul. Stanisława Żaryna 2A, operates as an Insurance Agent and is entered into the Register of Insurance Agents under RA number 11162860/A (https://rpu.knf.gov.pl/). We perform agency activities for several insurers.

Contact form

If you are interested in our offer and want to get detailed information please fill in the form below - we’ll call you back!

Already have a mortgage with Bank Millennium?

Check out our guide to mortgageslink otwiera się w nowym oknie and learn more.