Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

Update the browserCheck three ready-made Plans

Investing which is socially responsible

Stain Plan, Balanced Plan and Active Plan are based on ESG sustainability criteria. It means that you'll find in their portfolio companies which focus on growth in this spirit.

If you invest in this investment funds, you support:

- environmental aspects

- social aspects

- corporate governance issues

How to start investing

You can conveniently open Millennium Investment Programme in Millenet and the mobile app or in a branch.

-

1

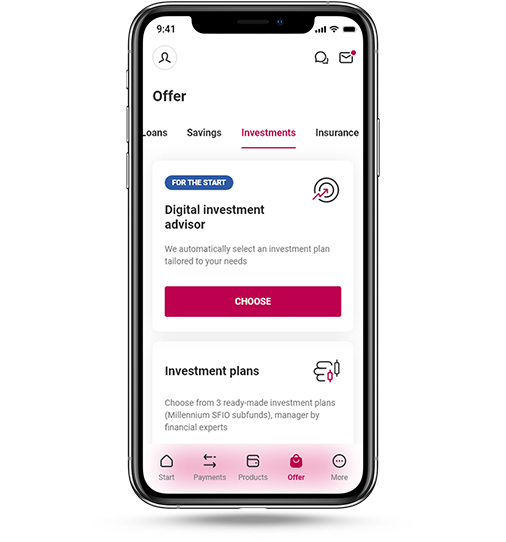

To set up a plan online, from the menu in the app, select Offer > Investments > Investment plans

-

2

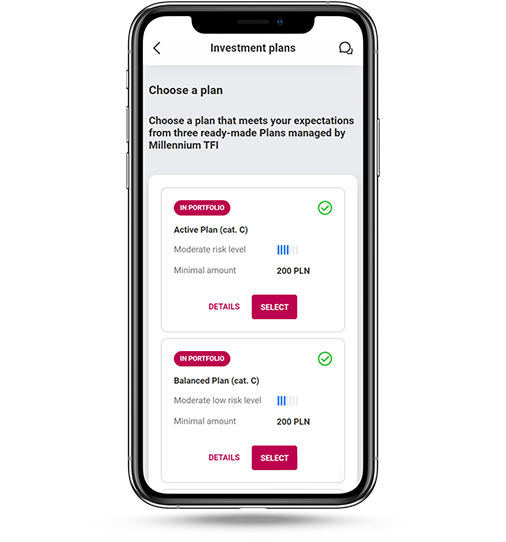

Check the details of the Plans to choose the best one for you.

-

3

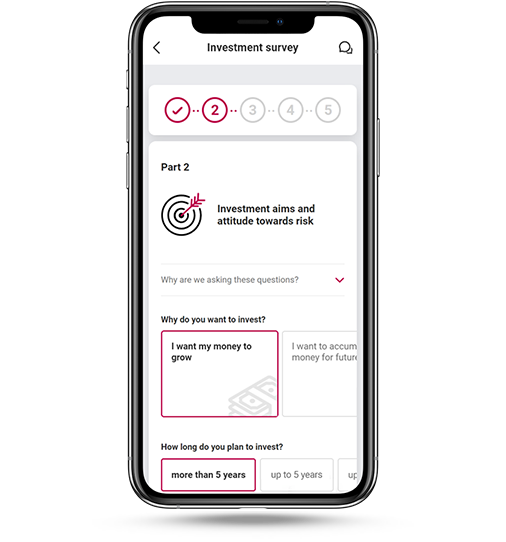

If you do not have a completed and up-to-date investment survey, we will ask you to complete it, and if you do not have a signed framework agreement, then also conclude it – everything will take you just a few minutes.

-

3

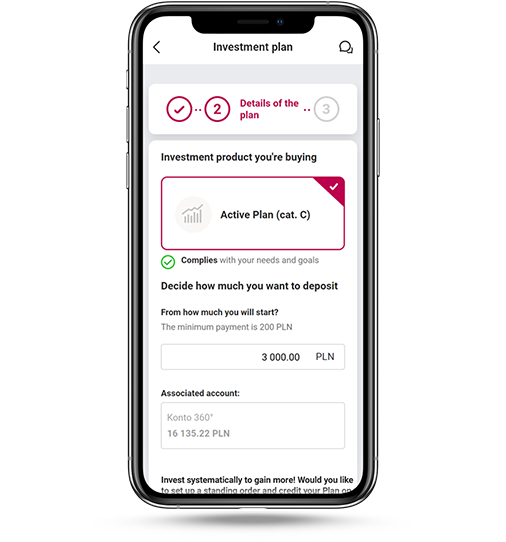

Specify your plan details and make your first deposit. To invest regularly, you can create a standing order.

-

4

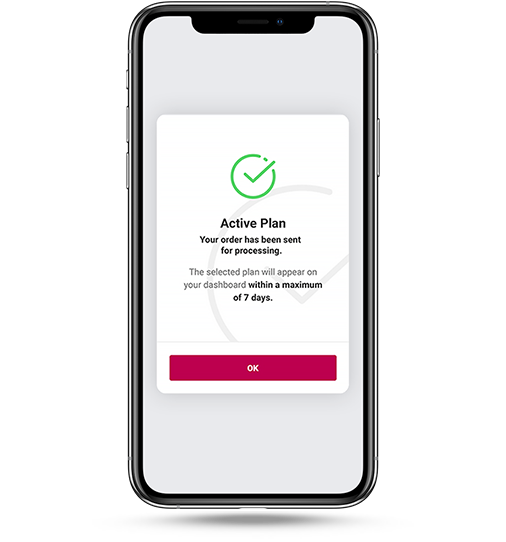

Done! Opening the plan has just been ordered. The order will be processed within 7 days, then after logging in to your account you will see a tile with a new product.

Quotations

Details and fees

- Plan investment time

You don't have to declare anything today. You have full flexibility. It is up to you when you want to withdraw funds. You always have access to your funds, regardless of when you decide to withdraw them.

The investment period is the period from the date of execution of the order to purchase individual sub-fund participation units under the plan to the date of execution of the order to buy back these units.

Worth knowing

-

Withdrawal of invested funds from the Plan

You always have access to your funds. In first 12 months after execution of your investment each withdrawal from the plan will be charged a handling fee.

-

Change of plan in the course of investment

You can change your plan to a different one at any time. Conversion is completely free. Remember that if you open a new register, the period in which fees are charged for withdrawals will be counted from the beginning.

-

Investment increase

You always have the opportunity to make subsequent payment into your investment plan.

-

Establishing multiple plans

You can open numerous plans and divide your funds into selected plan.

Just starting to invest?

Complete the MiFID questionnaire

The questionnaire consists of several questions. Answers to these questions will allow you to find out what type of investor you are. And they will allow us to present you with products that meet your needs, expectations and investment experience, and are suitable for you.

- ???link.opens.in.new.window??? Active Plan Subfund - key information for investors - in Polish

- ???link.opens.in.new.window??? Balanced Plan Subfund - key information for investors - in Polish

- ???link.opens.in.new.window??? Staid Plan Subfund - key information for investors - in Polish

- ???link.opens.in.new.window??? Millennium FIO Prospectus - in Polish

- ???link.opens.in.new.window??? Millennium SFIO Prospectus - in Polish

- ???link.opens.in.new.window??? Millennium SFIO AFI Information - in Polish

Questions and answers

-

How to start investing in Bank Millennium?

You will get access to the offer of investment products at Bank Millennium after completing the investment questionnaire (appropriateness assessment) and signing the Framework Agreement for the provision of financial services. Thanks to the answers provided in the survey, we get to know your knowledge and previous investment experience, and we are able to assess whether the selected investment product is adequate for you and in line with your needs, characteristics and goals. If you want to get access to investment products in the mobile app and in Millenet, you will also need to sign a service access agreement via electronic banking channels.

You can fill in the questionnaire and sign the contract conveniently in Millenet, Bank Millennium mobile app or any Bank branch.

-

How Millennium Investment Plan works?

If you already have an access to the investment product offer in Bank Millennium, you can select a Plan which meets your expectations as to the level of potential profit and level of potential risk. Thereafter, declare the amount and your funds will be invested in a package of mutual funds in accordance with the policy of your chosen plan.

-

What should I do to start investing in Millennium Investment Plan?

You can open the plan in Millenet, mobile app or any Bank Millennium branch. Minimum amount of first and each subsequent payment is 200 PLN.

-

What are my funds invested in under Millennium Investment Plan?

Millennium Investment Plan consists of three ready to purchase investment plans (Staid, Balanced and Active) which differ from each other in risk and reward profiles. Each of them offer funds diversification, i.e. simultaneous investment in many global investment funds selected by experts from Millennium TFI. Thanks to this, you limit the risk of investment, spreading it on various investment strategies, and you benefit from the potential of global markets at the same time.

You decide which plan meets your investment expectations. You can find more information about the investment strategy of each investment plan in the Fund Fact Sheet and in KIID.

-

Are regular payments into Millennium Investment Plan necessary?

Regular payment into Plan are not required. Subsequent payment can be made at any time. The minimum amount of each subsequent payment is 200 PLN.

What is important, the long-term regular investments of even small amounts gives an opportunity to accumulate significant capital in the future. Furthermore, if you make payments in different periods, you average the price of participation units. It can have an influence on limitation of risk of purchasing all participation units at the least favorable price.

Important information

Risks

-

Risks

Financial transactions involve risk presented in “Description of Risk Involved with Financial Instruments and Products for Private Persons in Bank Millennium S.A.", available in branches and on the Bank’s website www.bankmillennium.pl.

Investing in funds involves risk of a loss as well as the obligation to pay handling fees and income tax. The Fund does not guarantee attainment of the investment goal or a specific investment result. The net value of funds’ assets is highly volatile due to the composition of the investment portfolio. In cases, in which the Fund’s Articles of Association provide for the possibility of investing more than 35% of a Subfund’s assets in securities - the issuer, surety or guarantor of these securities may only be the State Treasury, NBP, US government, European Central Bank or the European Investment Bank.

Millennium Investment Plans may not be consistent with your knowledge, experience, financial situation, risk tolerance or investment objectives.

At the product selection stage, taking into account the answers provided in the investment survey, we always provide information whether the product is compatible with your features, goals and needs. In the event of non-compliance or incomplete compliance of the product with your characteristics, goals and needs, we will give you an appropriate warning, and the purchase can only be made on your initiative.

-

Investment Fund – is an entity with legal personality operating under the Act of 27 May 2004 on investment funds and management of alternative investment funds. An investment fund’s sole operation consists in investing monies collected publicly or privately in securities, money market instruments, and other property rights stipulated in the Act.

In return for payments into the fund investors receive participation units. Their number shows proportional share held by the investor in the investment fund assets. In specified time intervals the fund determines the value of participation units i.e. calculates „net value of fund's assets" assigned to a single participation unit. For this purpose, the fund determines the value of its investment portfolio and divides it by the number of participation units allocated to all participants. The value of participation unitmay change on each valuation day.

-

- sector risk,

- credit risk,

- risk of short-term price changes,

- FX risk,

- risk of non-admission of the issuer’s securities to trading on the regulated market,

- liquidity risk,

- tax risk,

- legal risk,

- settlement risk,

- market risk,

- interest rate risk,

- loss-of-capital risk,

- risk involved with concentration of assets or markets,

- amount of fees,

- product complexity.

Prior to making an investment the information about funds should be read, including financial data and description of risk factors, which are contained in Prospectuses and in Key Information for Investors (KIID), available together with the Funds’ fees table in Bank Millennium branches, in the offices of Millennium TFI as well as online at www.millenniumtfi.pl.

Conclusion by the customer of transactions involving financial instruments is the basis for consideration that the customer has read the terms and conditions of the transaction as well as the related risk and has accepted them.

-

Monies invested in investment funds are not protected by the Banking Guarantee Fund, in keeping with the Act of 10 June 2016 on Banking Guarantee Fund, system of protection of deposits and compulsory restructuring.

-

All and any information contained in this commercial publicationis for information purposes only and does not constitute an offer, or a recommendation or an invitation addressed to anyone (or any group of persons whatsoever) to conclude a transaction involving the financial instruments presented herein. In particular the information contained in this publication does not constitute an offer in the meaning of the Civil Code of 23 April 1964 nor is it a service of investment, financial, tax, legal or any other advice. Any investment decision should be taken on the basis of information contained in Prospectuses and in Key Information for Investors (KIID), not on the basis of the abbreviated description contained herein.

Dissemination, distribution and trading of some financial products may be subject to restrictions with respect to certain persons and countries, in keeping with relevant legislation. It is for the customer to demonstrate legal capacity and authority to invest in the financial instrument. Offering and trading of financial instruments may be done only in compliance with relevant legal regulations.

Information contained in this publication shall be made available to the recipient on an exclusive basis. The recipient is not authorised to copy or send and make the information available in whole or in part in any other way to third parties (except its sending to professional advisors) without the Bank’s prior written consent.

MiFID

Markets in Financial Instruments Directive

-

Markets in Financial Instruments Directive

MiFID (Markets in Financial Instruments Directive) is the European Directive concerning the market of financial instruments and products, which sets down a uniform legal framework for banks, brokerage houses as well as other brokerage operators in the European Union as well as in Iceland, Norway and Lichtenstein.

The MiFID Directive aims to enhance and harmonise Client protection in banks, increasing consistency and transparency of the operation of banks as well as increasing competitiveness on the financial instruments market.

-

Look here to find basic information about MiFID. More

-

Read about Client classification rules and the Bank's obligations. More

-

We will check, which financial instruments and products and investment services are appropriate for you. More

-

Read about the nature of financial instruments and products and related risks. More

-

We operate in a reliable way and in the Clients' best interest. More

-

Look here for all documents about MiFID in Bank Millennium. More

Contact us

-

Fill in the form

Need more info? Write to us

-

or call - helpline avaliable 24/7