02.02.2022

Bank Millennium in cooperation with Asseco Data Systems has introduced a qualified validation and maintenance service for e-signatures

As part of the cooperation, the possibility of automated checking the validity and maintenance of signatures and electronic seals submitted by the client, the bank and a third party was made available in the processes of remote service for companies at Bank Millennium.

Bank Millennium, wanting to improve the internal processes of signing documents and responding to the expectations of customers, decided to develop a package of trust services. With the support of Asseco Data Systems, the bank implemented services in its infrastructure and made it possible to obtain confirmation of the validity of submitted signatures and electronic seals.

"The existing trust services we used at Bank Millennium have been enriched with new tools that are a significant step towards the digitalisation of business service processes. Thanks to the qualified validation and maintenance of electronic signatures, we have managed to facilitate for both customers and bank employees the ongoing verification of electronic signatures, as well as ensuring their long-term durability. The new services are fully integrated with the circulation of documents in the Millenet for Companies electronic banking system, which in our opinion will additionally encourage customers to conclude contracts with the bank in electronic form. – Jarosław Ożóg, Project Manager, Bank Millennium, emphasises.

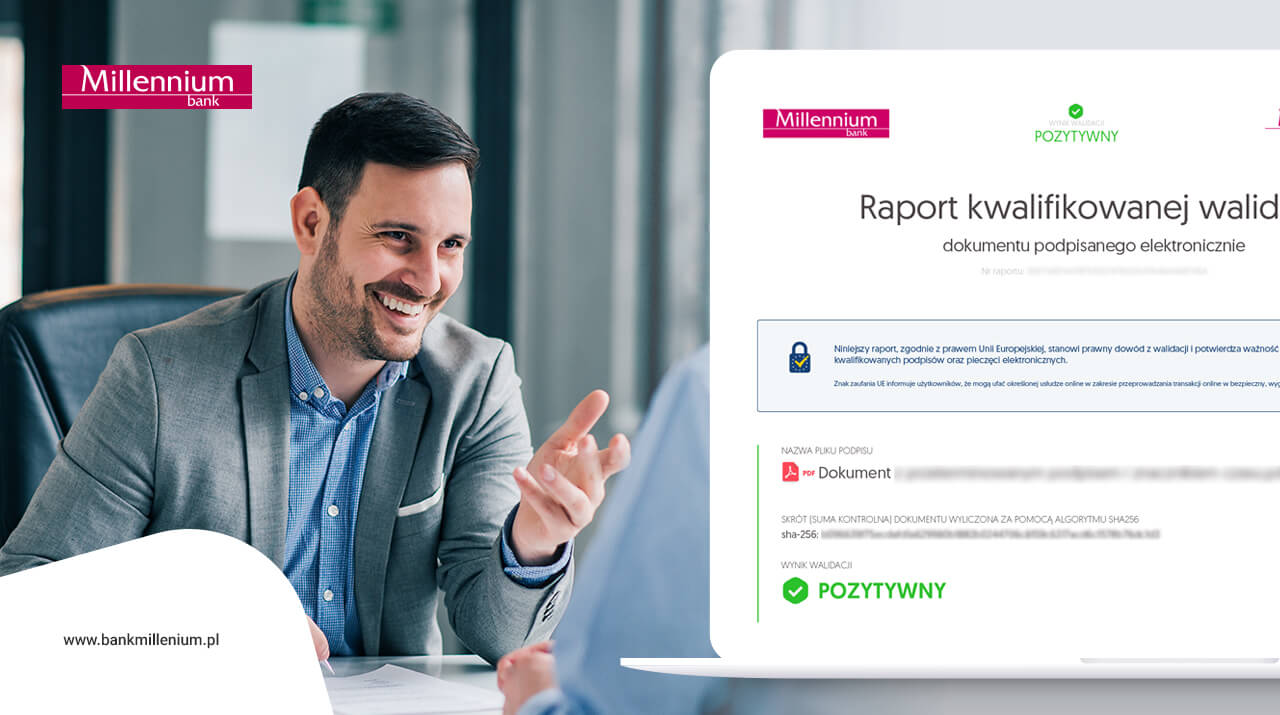

Qualified validation is the process of verifying and confirming the validity of an electronic signature and an electronic seal on a digital document. It is a guarantee that it has not been changed after signing and that a valid qualified certificate was used at the time of signing. Responsibility for the result of the signature verification process lies with the provider of this service – in this case Asseco Data Systems.

The qualified maintenance service provides long-term legal and technical protection of the evidential value of a qualified e-signature or seal, linked to a specific electronic document. This service secures evidence of qualified validation and the integrity of the signed content both in formal as well as legal terms, and increases the level of cryptographic security. From a technical point of view, this involves the use of appropriate cryptographic algorithms in conjunction with the time-stamping of evidence from the qualified validation process.

Qualified validation and maintenance services complement the entire life cycle of an electronic document, from the moment of submitting an e-signature or e-seal to archiving in the long term with full security. - The Bank Millennium team decided to use in its processes qualified validation and qualified maintenance of e-signature and e-seal, which are trust services in accordance with the eIDAS Regulation. These solutions are still little known, although very important from the point of view of electronic document management. The whole project was prepared and implemented within a few months with the great involvement of project teams from both parties – Patrycja Wiktorczyk, Chief Analyst, Asseco Data Systems, recapitulates.

The scope of the project included the implementation of the Validation Gateway integrated with the qualified WebNotarius service, stylistic adjustment of the validation certificate to the bank's visual identification and providing maintenance evidence. During the implementation of the project, the bank could count on full support from Asseco.

Currently, both trust services – qualified validation and qualified maintenance of e-signatures and e-seals – are provided in Poland only by Asseco Data Systems.

More about Bank Millennium's offer for businesses at: www.bankmillennium.pl/przedsiebiorstwa.