Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

Update the browserAbout the Finance Manager

Finance Manager is a free service enabling budgeting personal finance. Thanks to the Finance Manager you can easily control your expenses and manage savings.

Who can use this service?

For every Customer of Bank Millennium who wants to quickly and conveniently manage their household budget.

All you need:

- an active current account, credit card or to be a user of prepaid card in Bank Millennium,

- access to the transactional system - Millenet.

Finance Menager presents the history of transactions for a period of 12 months, thus providing a detailed analysis of spending history.

Finance Manager advantages

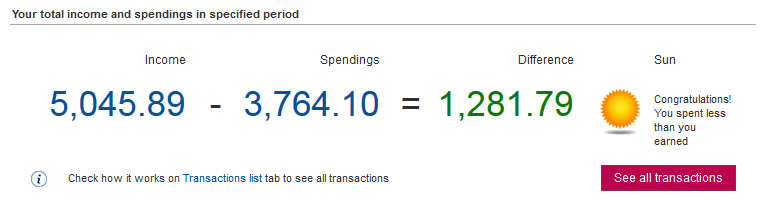

Current ratio between income and expenses

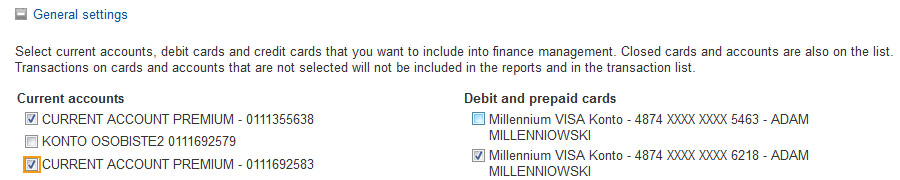

Data present the household budget, reflecting incoming and outgoing transactions on accounts and cards, which you want to include in the analysis.

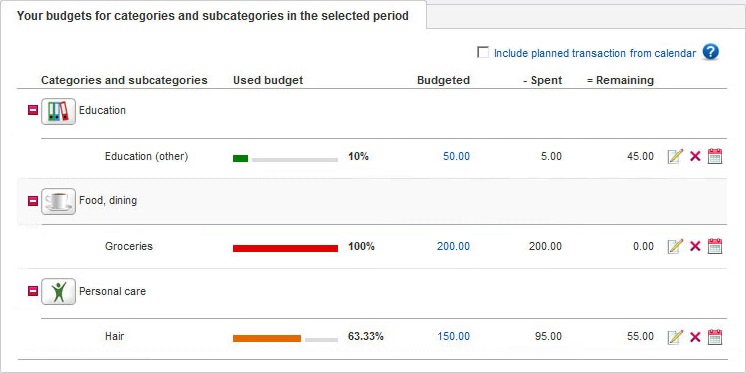

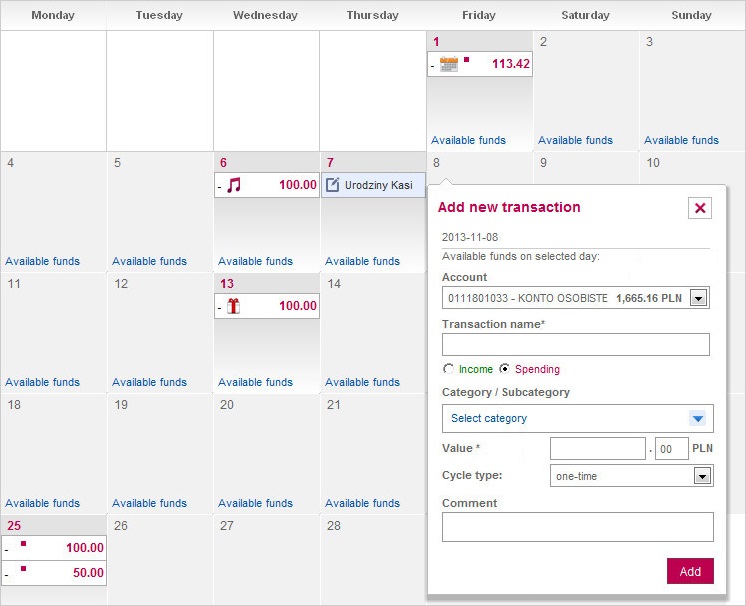

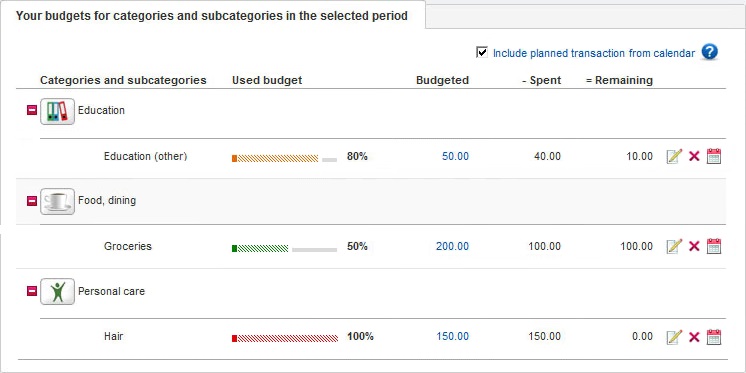

Creating the budget

You can define your expenses, specifying the amounts you want to allocate per month to individual spending categories and subcategories.

Texts

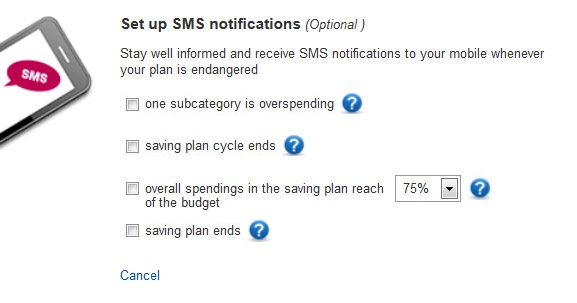

When you have reached a certain amount of spending in a category or subcategory, the system will text you with an appropriate warning.

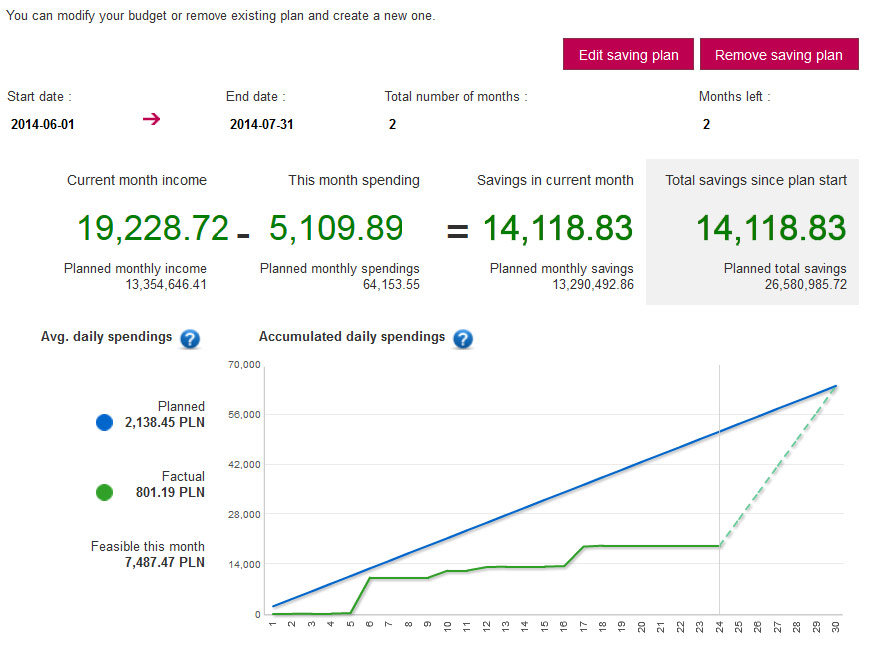

Creating a saving plan

Define the amount and time horizon for the saving plan and the system will suggest the categories and subcategories, where you can spend less.

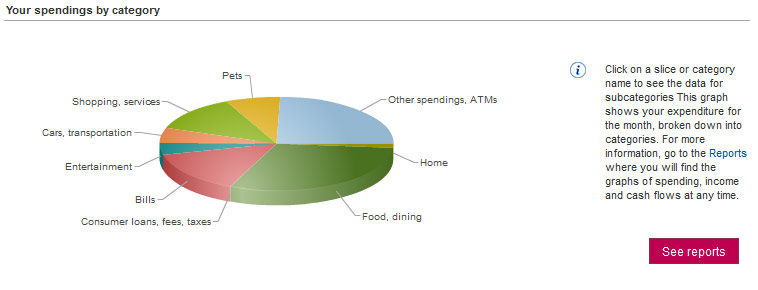

Graphic analyses

System presents analysis results in the form of charts. Various charts are available, presenting the sum of incoming and outgoing transactions.

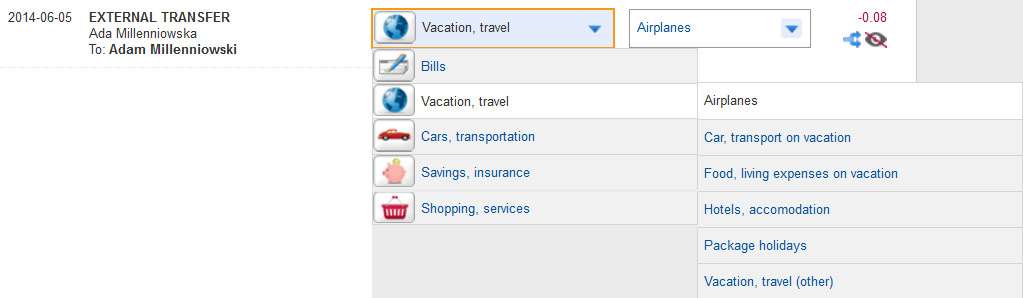

Expense and income categories

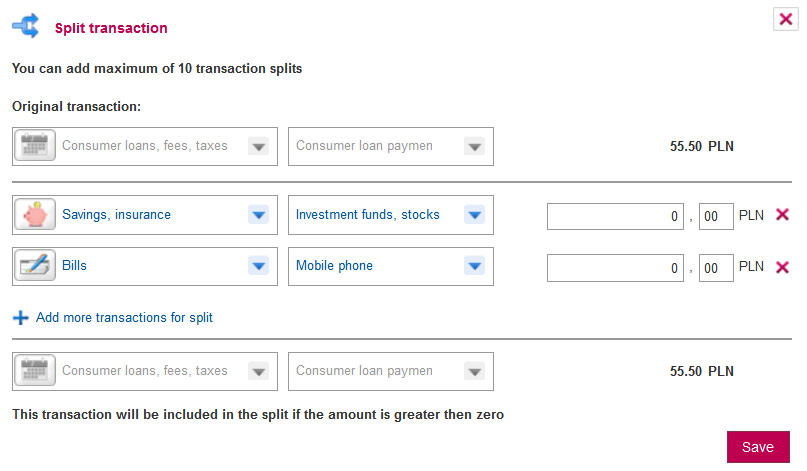

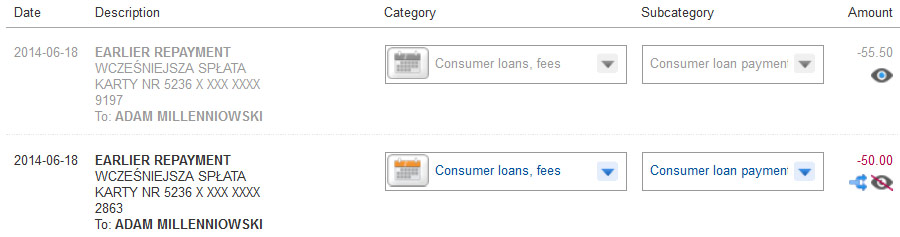

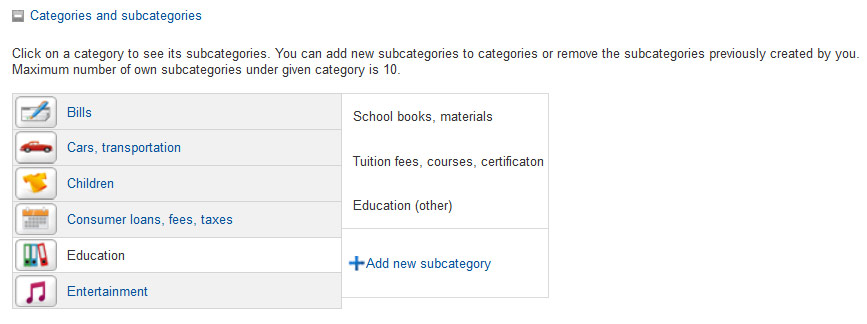

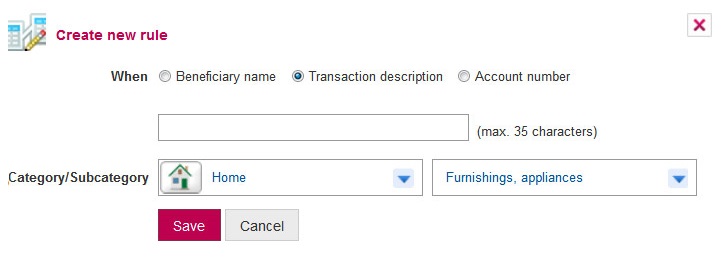

Transactions done on your accounts and cards are automatically assigned to categories. You can change categories and add your own subcategories.

How to start

Log on to Millenet and select Finance Manager

Set the start day of your month*

Enjoy all the possibilities, which Finance Manager offers

*You can change period when your month will start in Finance Manager. This month will be available for dashboard, budget, reports and saving plan.