Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

Update the browser-

Can anybody use Finance Manager?

Finance Manager service is available to every Bank Millennium Customer. It is enough to have active current account or a credit card or to be a user of prepaid card/supplementary card in Bank Millennium and have active access to the transaction system Millenet for Individual Customers.

If you are not our Customer, yet, take advantage of our attractive current account and credit card offer and enjoy functionalities of the Finance manager free of any charges!

-

What needs to be done to use Finance Manager?

It is very simple to use Finance Manager. You just need to log on to Millenet and select, from side Menu, an option My Finances and Finance Manager and you can enjoy the new functionality.

Review your expenses and plan your savings using Finance Manager!

-

Are there any charges for use of Finance Manager service?

No. Every Bank Millennium Customer can use Finance Manager with no charges at all. You are free to take advantage of our new service without fear that the Bank will collect fee or commission.

From now on, wherever you are, you will have your personal Finance Manager free of charges!

-

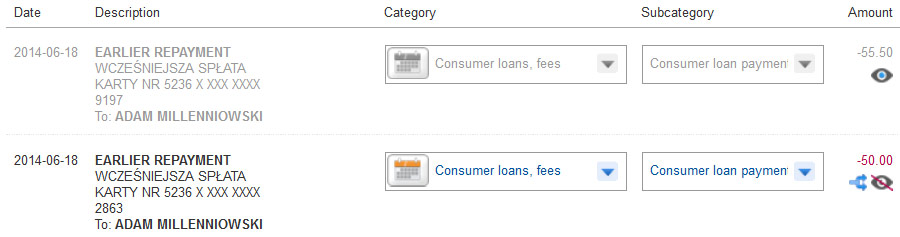

What transactions are included in the Finance Manager?

Finance Manager incorporates majority of transactions incoming and outgoing from your current accounts as well as payments made with cards. Finance Manager does not incorporate transactions having impact upon the balance of Customer expenses and incomes such as early/regular repayment of credit cards etc.

In addition, there i san option to exclude transactions between Customer's own accounts, transactions involving deposits and transactions between current and savings accounts. Should you wish to exclude these transactions, select tag Settings and in the section General Settings select transactions on the list Transactions shown in Finance Manager.

-

Can I manage my expenditures from different accounts and made with different cards at the same time?

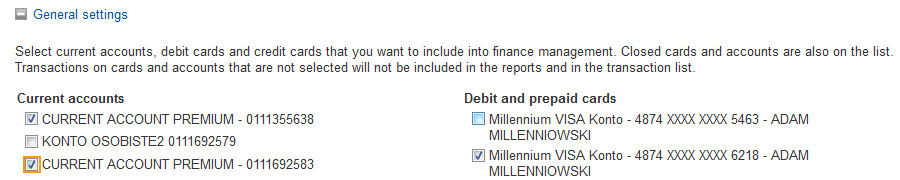

Yes. The Finance Manager is a flexible tool supporting selection of accounts and cards held in Bank Millennium, to be included in calculations. To include or exclude specific accounts and cards from or in the analysis, select Settings and in General Settings tick or select appropriate items. For your convenience the Finance Manager incorporates also closed products from available history of transactions.

-

Where can I add a new purchase subcategory?

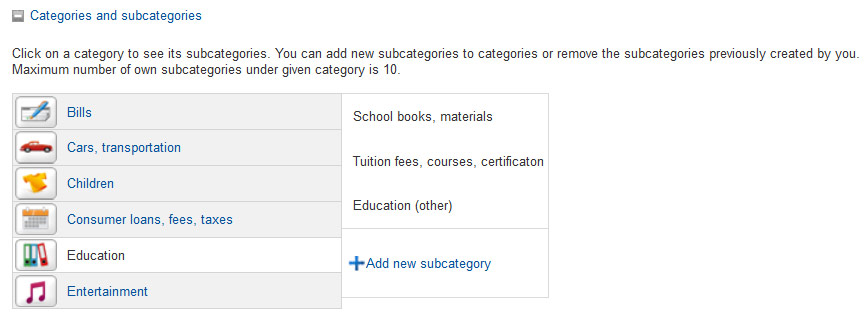

A new purchase subcategory can be added in section Settings, area Categories and Subcategories. After selecting a given category on the right hand side, a list of its subcategories will be displayed. At the bottom of the list, there is a button to click on to add a new subcategory. The new subcategory can have any not repeated name (not longer than 50 characters). You can add maximum 10 new subcategories.

You can remove a subcategory added earlier yourself in the same location.

-

How to change assignment to a category?

In section Transactions, there is a list of transactions included under calculation. In the column Category, by every transaction, there is a roll-down list to select appropriate category and, subsequently, subcategory. Finance Manager facilitates multiple changes of assignments to categories; hence, it is an extremely flexible tool to manage household budgets.

-

Can I change types of graphs presented?

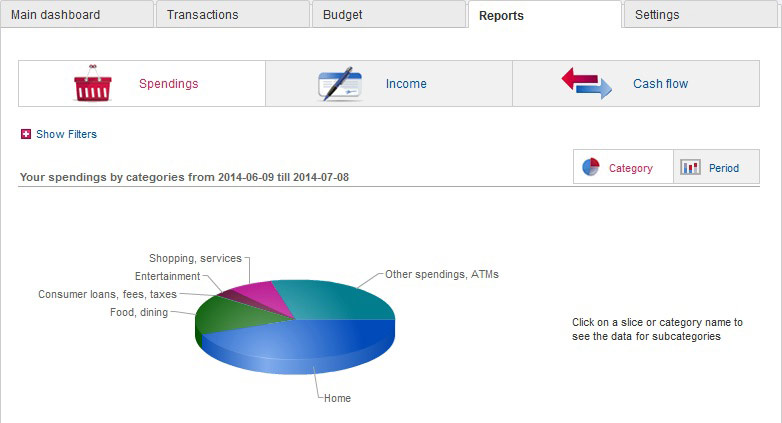

Tag Reports in the Finance Manager helps you analyse your transactions using different graphs in the following three areas: expenditures, incomes and cash flows. In the area of expenditures and incomes, you have a choice of two types of graphs: with breakdown by categories and subcategories in a given time period (pie chart) or by individual time periods (bar chart). In the area of cash flows, a bar chart is available with additional line presenting net income after expenditures.

-

Can I obtain calculation for another person (mother, husband)?

If your mother is a co-owner of the account, she will also have access to Finance Manager, she should only log on to Millenet using her own MilleKod.

Each co-owner, by logging on using his/her own Millekod, can change categories, add his/her own categories and rules. New settings added this way will be visible only to the Customer who has added them and will not be available to co-owner.

Persons who are not Bank Millennium Customers but wishing to use our new service should open an account or a credit card in a Bank Millennium Branch or via the Bank website.

-

Which category will money withdrawn in ATM or using Cash Back service be assigned to?

Cash withdrawn from ATM or by way of Cash Back service is assigned to category manually by a Customer. Should you want to categorise transaction, select tag List of transactions find it on the list and click on it in the column Category and select category matching your actual use of cash.

-

Will transactions in foreign currencies be incorporated in calculations?

Certainly! The Finance Manager includes all incoming and outgoing transactions except those marked by you in the tag Settings in section General Settings on the list Transactions shown in Finance Manager.

Foreign currency transactions are converted into PLN according to average NBP exchange rate as on the transaction date.

-

On what basis are my transactions categorised?

Bank Millennium, striving to facilitate your household budget management introduced a set of rules to categorise your transactions.

Transactions executed with a debit and credit card are assigned to a given category on the basis of a pre-defined code allocated to each transaction. On the other hand, transactions on accounts are categorised on the basis of rules pre-defined by the Bank and added by the Customer.

You may add your own rules in Settings, section Management of categorisation rules. Customer created rules may apply to both incomes and expenditures.

-

Yes, credit and debit card transactions in the process of authorisation are also taken into account by the Finance Manager.

-

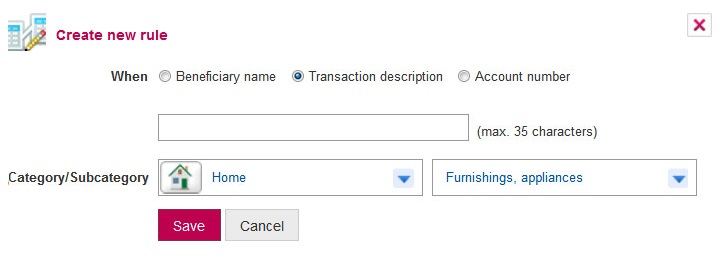

Can I define a rule to automatically categorise a given transaction?

Certainly! You can establish your own rules to govern both incoming and outgoing transactions. Rules governing outgoing transactions may be based on the name of receiver, transaction title or account number. On the other hand, rules applicable to incoming transactions may involve sender's name, transaction title or account number.

The text of the rule (maximum 35 characters) may contain one word or a whole phrase. The beneficiary's name may be just the first or last name, full name or alias (Adam, Millenniowski, Adam Millenniowski, Adaś, Misiek etc.). The title of the transaction may contain a detailed description (e.g.: electricity bill - then all electricity bills will be classified according to the rule) or only part of it (e.g.: bill - then various bills will be classified in the same way). The account number does not have to be full, it may e.g. be the last 10 digits.

You can add your own rule in Settings, section Rules management.The rules you add are more important for the system than those set-up by the Bank.

Application of the rules is very broad, for instance you can: define a rule, on the basis of which books bought in a specific bookstore will be treated as Education category, not Entertainment. Likewise shopping in a children's shop may be treated as Gifts, celebrations instead of Children.

-

Can I import transaction from another bank?

We recommend for all transactions to be executed through an account or card in Bank Millennium. This way, analysis performed by Finance manager will generate more comprehensive results.

-

What is the time period covered by analysis?

Finance Manager analysis covers the last 12 months.

-

Can I exclude a particular transaction from the Finance Manager?

Yes, you can exclude individual transactions from the calculations. E.g. when you get loan proceeds disbursed to your account then you can hide the transaction in order not to artificially overestimate income. You are able to hide any transaction available under the List of Transactions bookmark. To hide/unhide transaction use eye icon on the right from transaction.

-

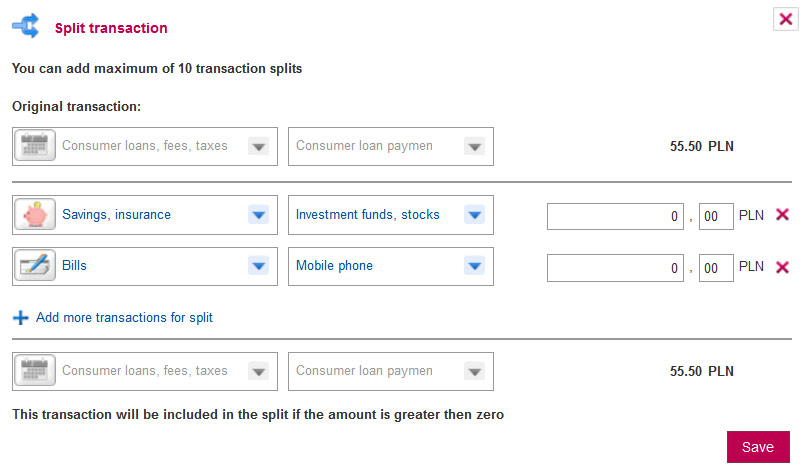

Can I divide transactions into individual purchase categories?

Yes, you can split transactions into smaller amounts, assign to them various categories and analyse expenses in even greater detail. E.g. when withdrawing money from an ATM or when shopping in a supermarket you are able to split a transaction into various categories: Food, dining - groceries, Entertainment - Books, magazines, newspapers, Shopping, services - cosmetics, cleaning products or other categories, which correspond to actual shopping.

-

What happens when I exceed my budget?

If you exceed your planned budget, the system will display the relevant information. You can also set up SMS notifications to be informed about budget usage without logging to Millenet.

-

On what basis does Finance Manager propose Saving Plan?

Finance Manager analyzes your average spendings per category and suggests in which categories you could be spending less to achieve your saving goal. The tool understands, that it may be difficult to cut spendings in some categories (i.e. bills), while in other categories making savings can be easier.

-

Can I edit the Saving Plan that was proposed by Finance Manager?

Of course. You can modify the Saving Plan proposal and adjust it to your needs. You can edit existing Saving Plan at any time.

-

What happens if I fail to save the desired amount in a certain month?

We understand, that saving the declared amount isn't always easy. If you fail to make the desired savings in one month, the Finance Manager will propose a Saving Plan update - it will suggest the categories, where you can make further spending cuts in order to achieve your saving goal.

-

How can I check the status of my Saving Plan?

On the Main Dashboard you will see the summary of your Saving Plan. If you exceed your budget in one or more subcategories, you will see an additional alert. You can also set SMS notifications for your Saving Plan to receive information about your spending and savings without logging to Millenet.

-

Will transactions added in Planner be included in my budgets?

Budget proposals for each category are made basing on analysis of your past spendings, therefore transactions planned in calendar do not impact budget proposals. Nevertheless, you can see how the planned transaction will affect the consumption of your budgets. In order to do this, check the option Include planned transactions from calendar on the budget tab.

-

Can I enable/disable SMS notifications at any time?

Of course. Go to Settings tab in Finance Manager and expand the Notifications section to edit your SMS notifications settings.