Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

Update the browser

In reference to epidemiological situation in Poland we would like to remind you

- Bank safely from the comfort of your home, using mobile app and online banking system

- If you can – do your shopping as well as payments online

- In traditional stores use contactless payments with card or phone up to 100 PLN without PIN confirmation

- Only if you need cash, use an ATM. For the majority of our accounts cash withdrawals in Poland from any ATM are free of charge

- Please beware of scammers sending false SMS messages claiming your funds are blocked and stick to these basic security rules >

Currently, the waiting time for the consultant and the answer to questions sent via e-mail may be slightly longer. We ask for your understanding in this difficult time. We assure you that we do everything to answer all your questions as quickly as possible.

Bank securely

You can do so much without leaving your home

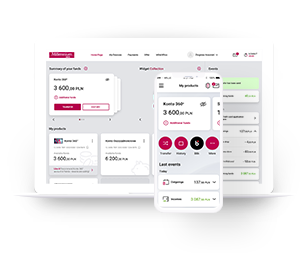

Remember that in Millenet and mobile app you will make most transactions safely and remotely

- Bank Millennium mobile app and Millenet online banking system are available 24/7

- you can sort out many administrative matters through Millenet online banking system in MilleAdministration tab

- pay for online shopping and in a stationary store make contactless payments by phone or card

How to start using the app?

-

1

How to start using the app? -

Download our app

Enter your MilleKod and received SMS P@ssword, then enter selected characters from your identifier e.g. PESEL number and Temporary P@ssword.

-

2

How to start using the app? -

Define PIN and P@ssword 1

Define a 4-digit PIN you will use to log in to the app and an 8-digit P@ssword 1 necessary to confirm transactions (e.g. transfers) and mobile app activation.

-

3

How to start using the app? -

Go mobile!

Now you can adjust the app to your needs - set your own background or functions available before logging in.

Change the daily limit for transfers in mobile app:

- Log in to Millenet

- Select General settings from the drop-down menu under your name

- In the Limits and security tab select Security settings, then click Edit and adjust the Mobile Limit, you can increase the limit to 50 000 PLN

Change the daily limit for transfers in Millenet:

- Log in to Millenet

- Select General settings from the drop-down menu under your name

- In the Limits and security tab select Security settings, then click Edit and adjust the Main Limit to your needs

Transactions up to 100 PLN without PIN confirmation

We have increased the limit for contactless payments

From now on you can shop and pay up to 100 PLN without entering PIN on payment terminal. Choose safe and contact-free payments with your plastic card and phone.

How does it work?

Card payments

- If you are a Mastercard holder, you can simply start paying with your card up to 100 PLN without entering your PIN.

- If you hold a VISA card, make one contact transaction with your card: place it in payment terminal or ATM and enter PIN.

Mobile payments

Without any setting changes you can start paying with your phone up to 100 PLN with no PIN confirmation. Just hold your phone close to payment terminal during payment.

Important info! Payment terminals are gradually updated by the operators. There might be a situation where at the selected store or service point contactless payment up to 100 PLN will require PIN confirmation.

Contactless payments by phone

How to start using contactless payments with Andorid phone:

- log in to app and select Payments - Contactless payments by phone from the menu,

- choose the card you want to use to pay and then select Pay by phone,

- you're all set! Before you will pay remember to activate NFC in Bank Millennium mobile app settings.

How to pay in the store:

- unlock the screen and hold the phone near the card reader. You don't have to start the app,

- payments up to 100 PLN don't have to be confirmed by PIN.

Pay special attention to:

SMS and e-mail messages

containing links to fake payment websites. They usually include information about funds being blocked allegedly on bank accounts due to coronavirus situation or calling you for preventive vaccination. They refer to nonexistent ordinances.

Websites

Links from these messages may lead to phishing websites stealing your data or gaining control over your device. Your data can then be used to take loans based on your credentials.

Social platforms

If a friend asks you through social media to urgently send him money through BLIK, make sure that it is indeed your friend as scammers can also take over accounts on social platforms.

Follow these basic security measures related to using online banking:

- do not pass your MilleKod login or other login data,

- do not log in to your account on other websites, use only Banku Millennium websitelink otwiera się w nowym oknie,

- do not enter your full PESEL, ID, passport number as well as phone number (during login we only ask you to enter 2 randomly selected characters from each identifier),

- read carefully each received from us text and PUSH message – check if the amount and transaction number are the same as in your order,

- if a friend asks you to urgently send him money, contact him directly first and make sure that it is indeed him,

- keep up to date with information on Związek Banków Polskich (The Polish Bank Association)link otwiera się w nowym oknie.