15.05.2023

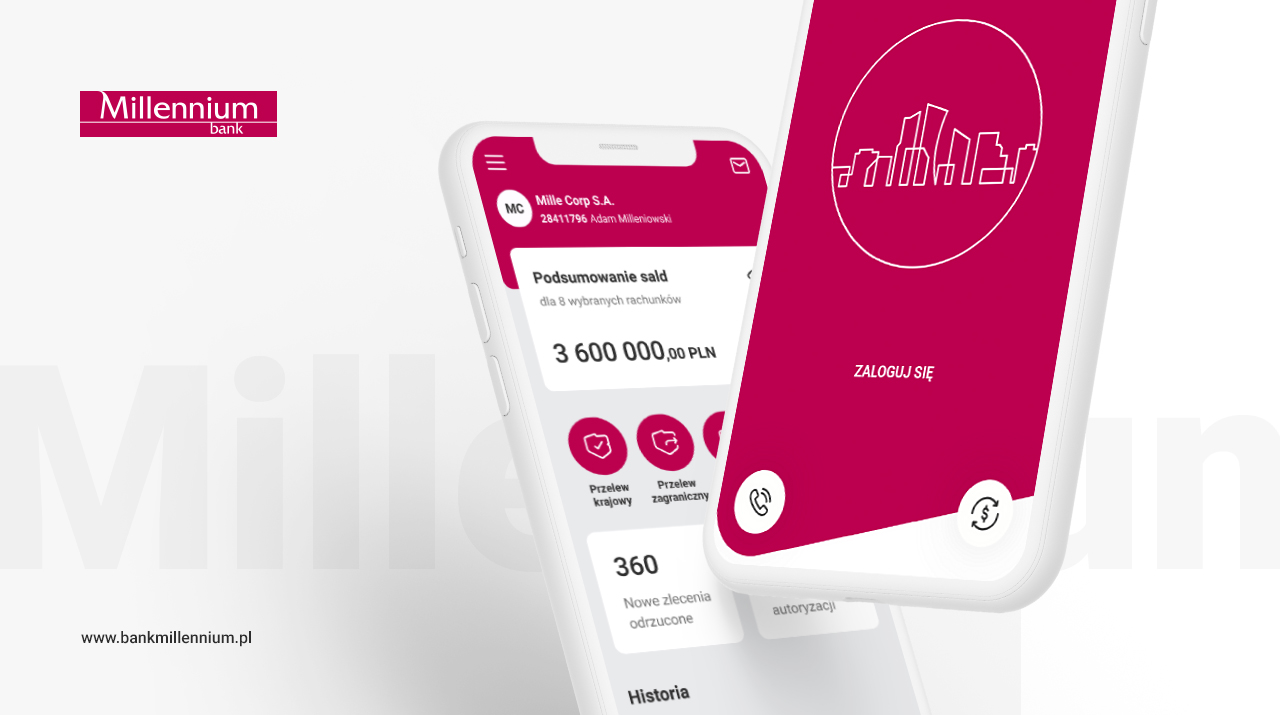

Bank Millennium has released a new mobile application for companies

The new Bank Millennium mobile application for companies was built from scratch. It was designed using the best practices followed by the bank when creating solutions for retail clients. It has been tested by companies. A friendly app, unique in terms of quality, was created, ready to handle large amounts of data, addressed to both small business owners as well as large corporations with extensive financial departments.

- We give companies a completely new product in terms of technology, with functions designed from scratch, tested by customers in a pilot, after which we received excellent feedback. We offer a completely new design, focused on the user's comfort, with great possibilities of personalisation. We refer to a large extent to our award-winning application for individual clients, because this is what representatives of companies expect from us, who want to have the best digital experience also in business services – says Antonio Pinto, Member of the Management Board of Bank Millennium - Importantly, the current version of the application is just the beginning. We will keep developing it, every few weeks we plan to provide new functions – he adds.

Full digitalisation of cooperation with companies is one of the bank's strategic goals.

- We want to be the leader of mobile banking for companies, which is why the mobile application addressed to entrepreneurs will occupy the same important place in the bank's strategy as the development of the website, integration of the banking system with the client’s financial and accounting system or circulation of electronic documents with a digital signature. Our strategic goal is to exceed 80% of digitalisation in corporate banking. There are areas in the bank where 100% of company orders have been going through digital channels for several years now. For two years, the number of contracts we conclude with clients in electronic form has also been growing dynamically – in 2022 it was almost three times higher than in 2021. In the credit area, it is already more than 50%. – says Andrzej Gliński, Member of the Management Board of Bank Millennium.

The construction of the new application was preceded by research and tests with users, which allowed us to understand the needs of such a diverse group of recipients. They showed, inter alia differences in the use of the application - large companies and people managing them use the mobile application mainly for control, smaller ones perform most banking transactions in it. Therefore, the possibility of personalising the application has been indicated as a key issue – it can be adapted to the needs of a specific user. Companies expect convenient, intuitive, personalised and reliable tools and solutions that optimise and automate the work of their financial departments.

- Before the first screen of the new app was created, we interviewed customers, carefully selecting the interlocutors. We took into account a wide, highly diverse spectrum of organisations and people who use our solutions. They were both owners of small companies who personally run their finances, as well as members of the boards of large corporations or of local government institutions, behind which there are extensive financial departments. Research has shown that user expectations are consistent to some extent. Everyone wanted the app to give them comfort, a sense of control and save precious minutes of their time. The scope of functions depended, of course, on many factors; primarily on the role of a given person in the organisation, the specifics of the company, but also individual habits. For our team, this was a completely new approach in designing for businesses. Although we have always focused on the client, now we thought of him not only as a company, but as a person who wants to best serve his or her organisation, and expects solutions from the bank that will help them in this – says Paweł Idzikowski, Head of the Corporate Banking Products Team in the Electronic Banking Department of Bank Millennium.

You can log in to the new app for companies biometrically in iOS. For Android, this form of logging in will be available soon. Instead of a password, all you need is a fingerprint scan or face recognition. This solution is extremely convenient and popular – over a million retail customers of the bank use this method of logging in.

In the application, you can manage multiple accounts at the same time, in one panel, and assign user rights flexibly, according to the needs of a given position.

Daily payments, which have been indicated by entrepreneurs as crucial, are very convenient. The application informs the user about many events on the account, i.a. receipts on the account, blockades of payments waiting for authorisation. A simple interface shortens the time of operations. Counterparties can be immediately checked on the white list of VAT taxpayers. In addition, you can easily generate confirmations and statements in the application, which can be sent by e-mail, Whatsapp, Messenger, Viber or other messaging system. Payments management is simple, the user can authorise payments quickly and securely. On the main screen there are two tiles – authorisation and rejected transfers, which allow you to immediately handle those transactions. Payments that are waiting for authorisation can be selected and confirmed by the user with one click. One click is also enough to accept an entire batch of orders.

The application ensures the security of users during the authorisation of orders, which is particularly important for large companies, in the case of multi-level transaction acceptance structures. It shows the full history of orders, who entered, modified and authorised them before a given user.

The new Bank Millennium application can be personalised by the user as needed. The user decides how the page looks after starting the application, has the ability to move and hide elements, add quick shortcuts such as domestic transfer, foreign transfer, VAT, history, can also set-up the dark mode.

The application offers context-sensitive help when using it - the system suggests possible usage scenarios , e.g. in terms of parameterisation of the home screen view or ways of selecting payments for authorisation.

- We used Flutter to create the new app. This is one of the latest multi-platform technologies, whose main advantage is the ability to use the same code in both iOS and Android versions, while maintaining high responsiveness compared to other solutions of this type. As a result, it gives significant savings, helps to maintain maximum consistency between the iOS and Android platform ecosystems and shortens the time of introducing changes and updates – sums up Jarek Hermann, Member of the Management Board of Bank Millennium.

In turn, the System Design approach was used to design the interface of the new application, the main advantage of which is to provide users with a consistent and structured experience. It is a standard that involves the production of "reusable" components and applying them when building applications. Thanks to this, the creation of new processes is much more effective, it also has an impact on the future development of the application. Thanks to the intelligent way of building interfaces, application users can also enjoy night mode or adjust the size of fonts to their own preferences. This will undoubtedly contribute to the convenience of using the application.