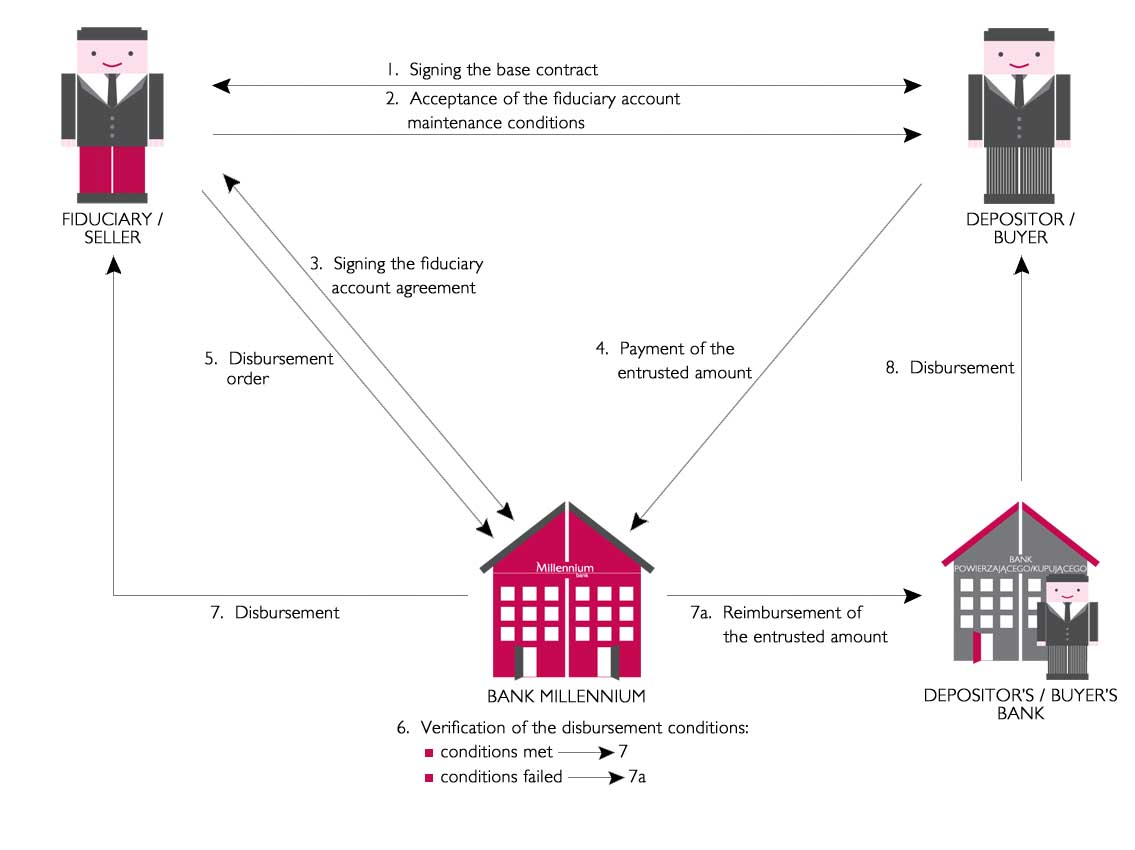

Trust and escrow accounts permit settlement of individual transactions (contracts) between counterparties. They also increase security of trade transactions concluded between parties who can jointly define the terms and conditions, under which money accumulated on the account is used. The Bank, as an institution of public confidence, carrying out instructions stipulated in the account agreement, controls disbursement of the entrusted funds.

Trust accounts are kept under par. 59 of Banking Law. The trust account agreement is for the purpose of settlement of a transaction resulting from a separate trade agreement and is signed between the Bank and the trustee. Money deposited on a trust account is protected from bailiff seizure and from inclusion in the bankruptcy or legacy estate of the trustee.

Escrow accounts are kept under par. 50 of Banking Law. An escrow account agreement is flexibly structured and may be a multilateral agreement.

Benefits:

- Security of settlements between the parties to a trade transaction.

- Adjustment of the terms and conditions of the agreement to the type and nature of the transaction.

- A universal legal structure and relatively low price as compared with similar banking products, which protect trade transactions, e.g. guarantees.

- Improvement of commercial and financial credibility of the transaction, especially in case of new trade relations.