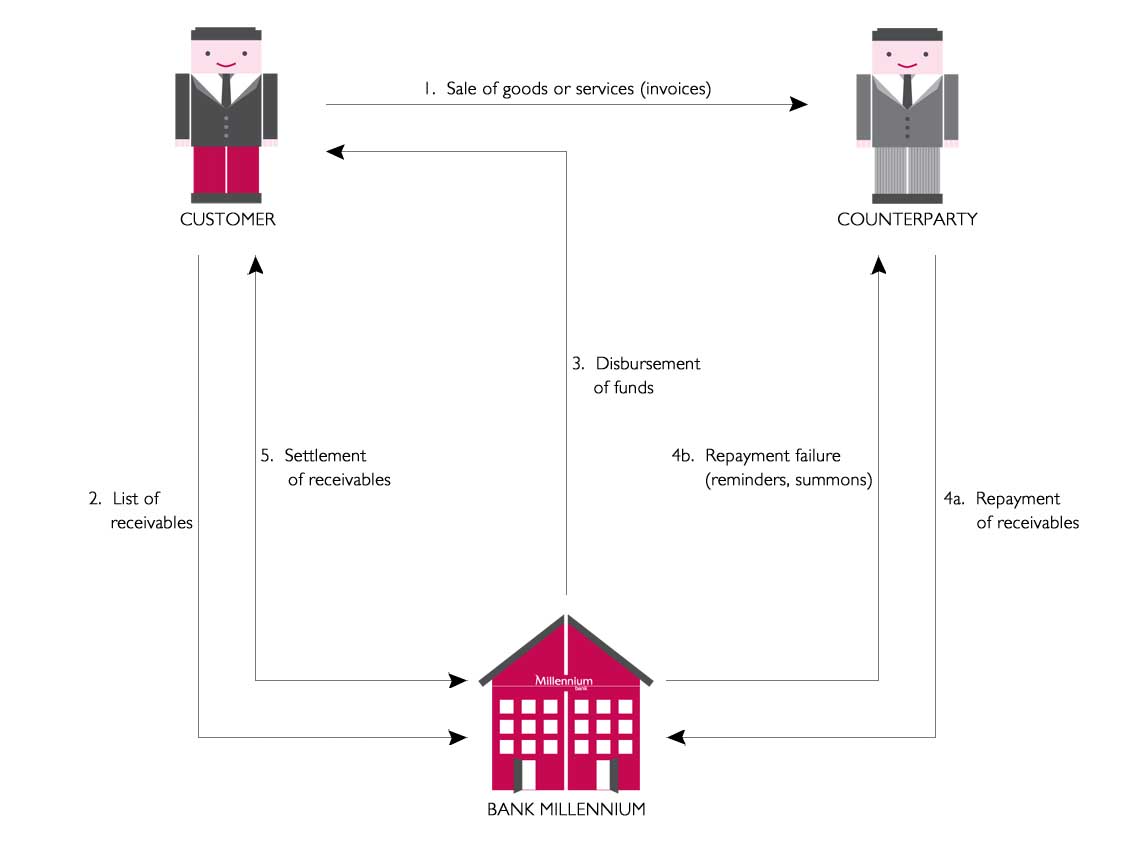

Recourse factoring is a pack of services consisting in comprehensive management of the Customer's receivables and financing his current activity by converting receivables frozen in invoices into cash.

Our offer to Customers:

- financing acquired receivables,

- receivables accounting and settlement,

- monitoring the timeliness of payments,

- claiming receivables, including performance of dunning actions with respect to defaulting counterparties (as agreed with the Customer),

- professional system to report the status of the factoring settlements together with the electronic data interchange module.

Benefits:

- possibility of obtaining financing based on a list of invoices sent electronically through the WEB Faktor system provided by the Bank,

- possibility of accrual of per cent or discount interest (to be chosen by the Customer),

- no minimum amount of the purchased receivable,

- matching financing to current needs of the Customer and the possibility of deciding about the final form of the service,

- no hidden fees connected with preliminary claiming of payments by the Bank,

- 24/7 access to the WEB Faktor system, permitting control of the status of settlements, without incurring additional expenses

- possibility of using other factoring services (such as recourse factoring with insurance or payments collection) under one factoring agreement.