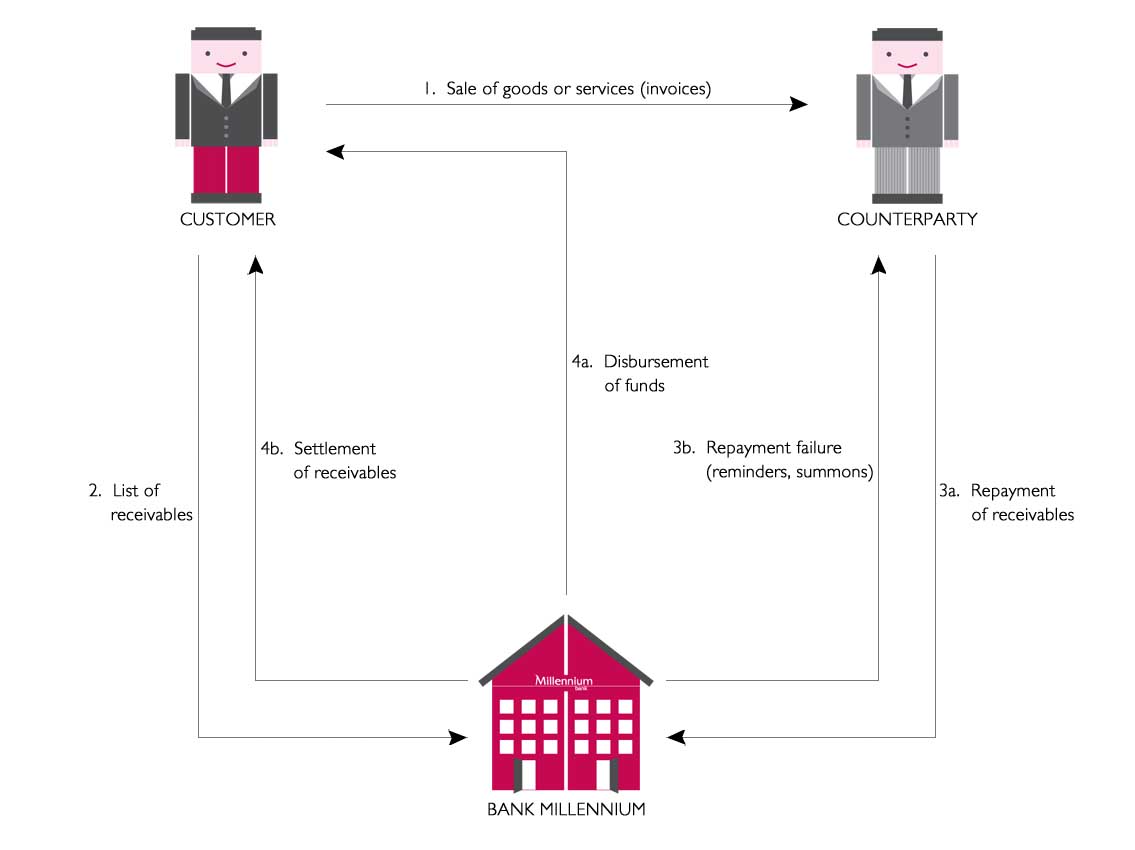

Within the receivables collection service we provide your company with managing and settlement of receivables, monitoring of payments' punctuality and collection of receivables, including possible dunning actions towards the counterparties late with their payments. Furthermore, we will provide you with WEB Faktor application that supports access to complete information about the current settlement status in a very clear presentation format.

For the transactions, you may report selected counterparties, whereas settlements are made both in PLN and foreign currencies. Receivables collection is offered under a single factoring agreement together with recourse factoring or non-recourse factoring with insurance.

Benefits:

- Taking over by the Bank the activities related to monitoring of punctuality of payments from your counterparties.

- No minimum amount of the receivable that may be presented to receivables collection.

- 24/7 access to WEB Faktor application provided to you by the Bank, that support making online factoring transactions and control of the settlements' status at no additional cost.