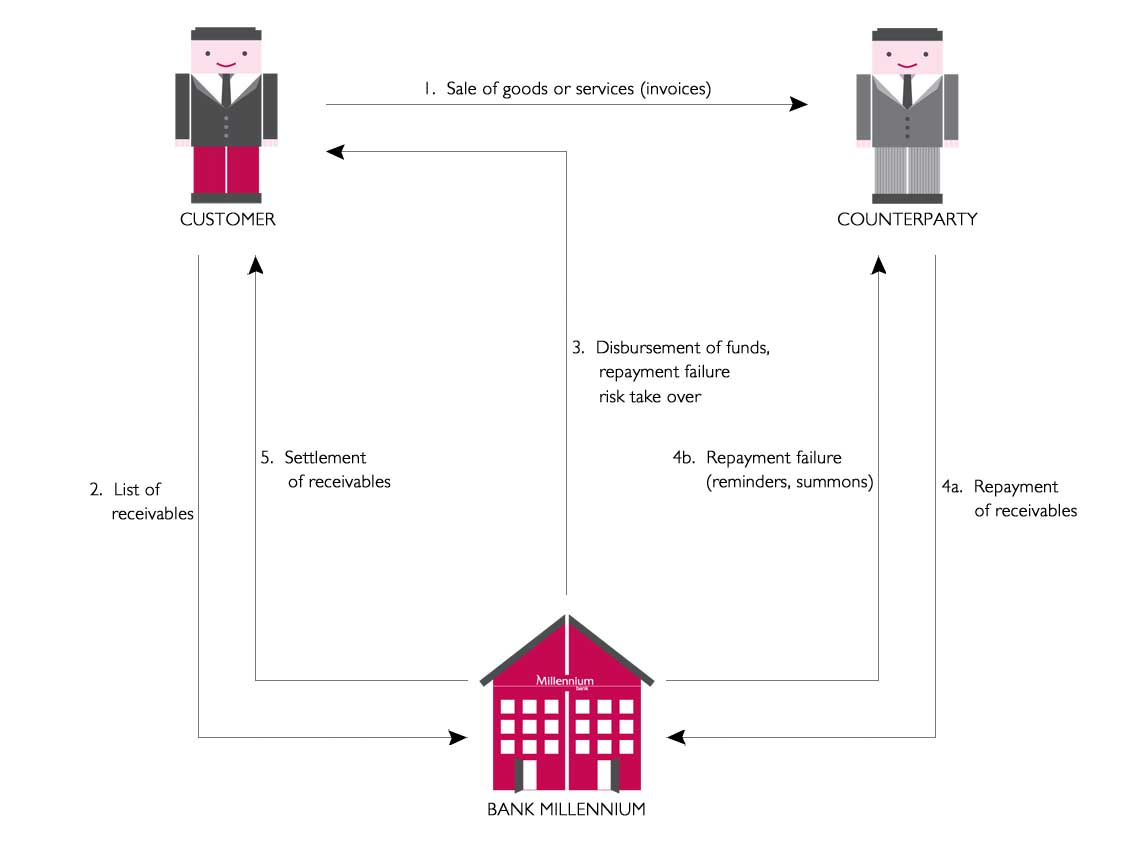

Within non-recourse factoring with insurance apart from obtaining quick financing, settlement and collection of the receivables you will be protected against lack of payment for goods or services sold.

Cooperation between the Bank and an insurance company gives your Company an opportunity to report for transactions not only domestic but also foreign companies and the counterparty's evaluation and granting them a limit does not require the presentation of financial statements. Settlements within the factoring agreement are in PLN as well as in foreign currencies.

Benefits:

- Access to financing of purchased receivables under the limit granted to the Customer and counterparty limits without additional collateral.

- Financing can be obtained on the basis of lists of receivables submitted electronically via the WEB Faktor application provided by the Bank.

- Protection against the risk of repayment delay by counterparties.

- The Bank takes over activities connected with monitoring and claiming the receivables.