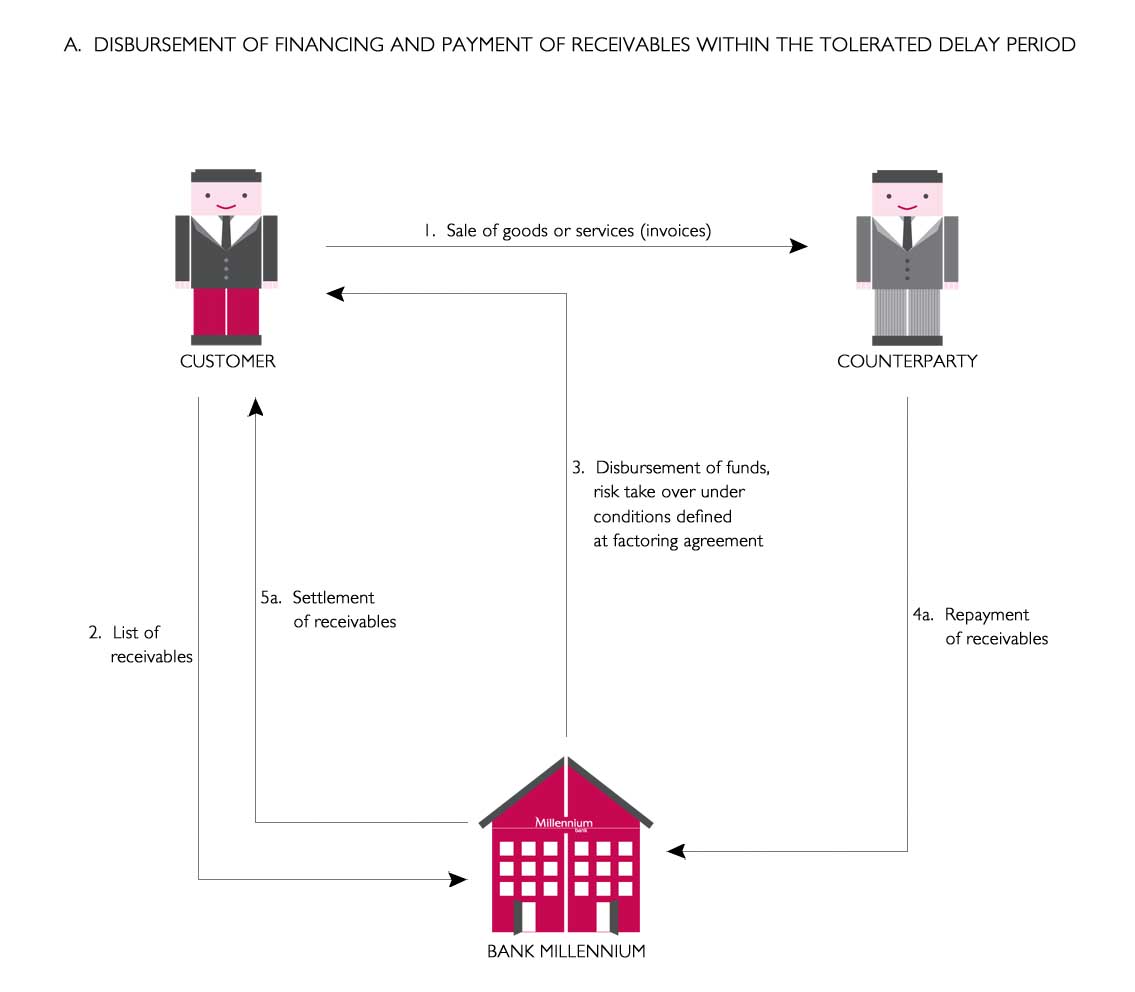

Non-recourse factoring with Client's policy is a solution within which apart from financing and managing receivables the Bank takes over the counterparty's insolvency risk (both domestic and foreign counterparty) within the area covered by the policy selected by your company and upon the principles specified in the factoring agreement. Settlements under the factoring agreement can be conducted both in PLN and in foreign currencies.

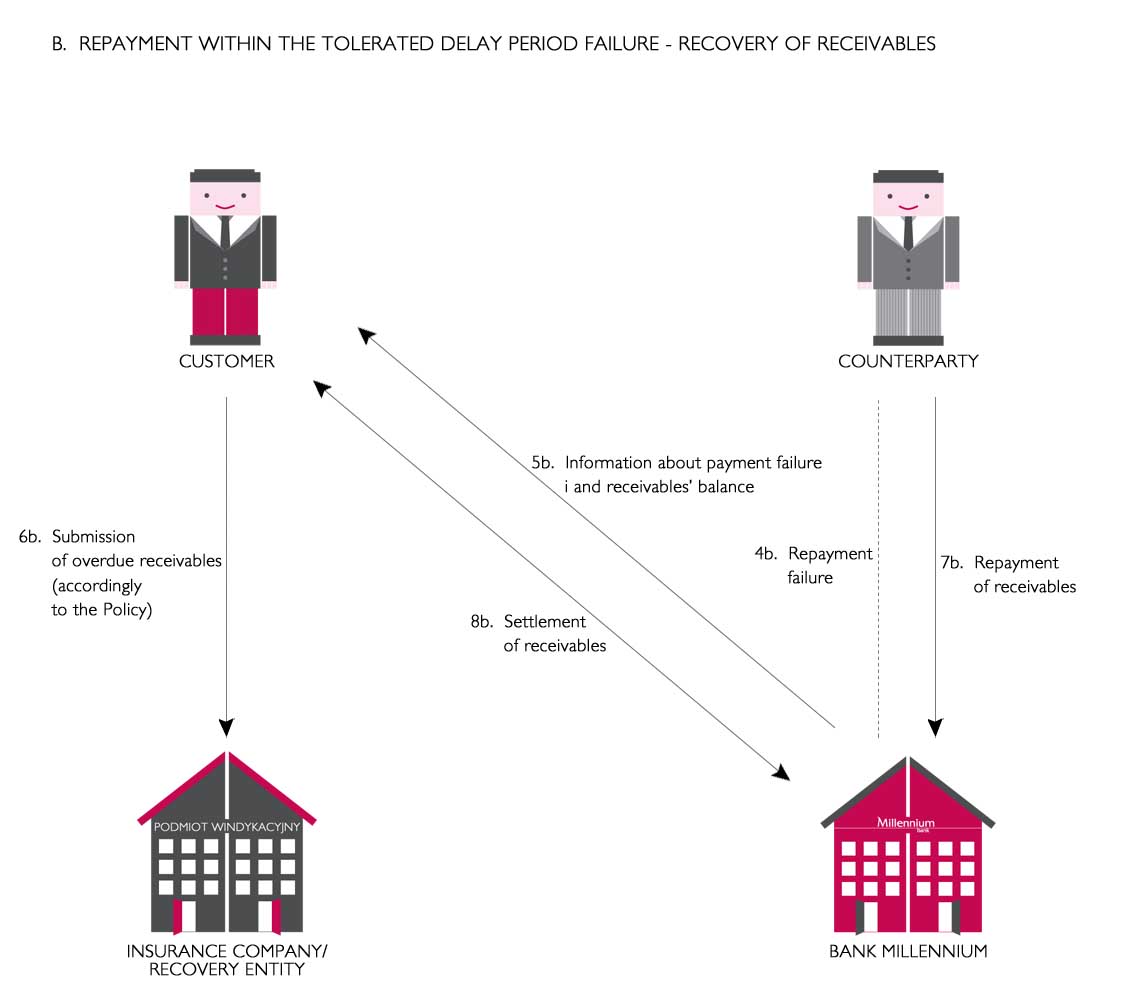

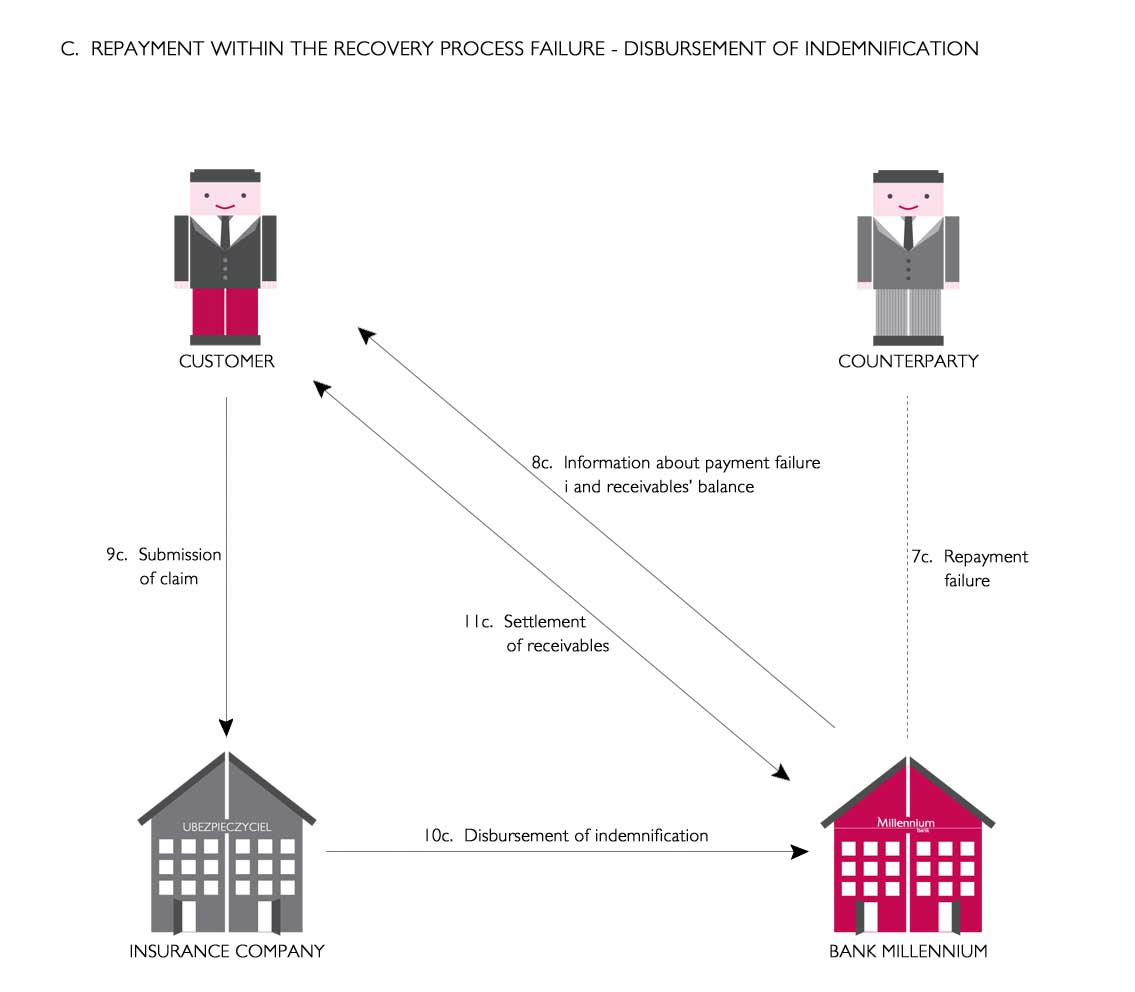

If you select this product, you will receive financing of purchased receivables within the granted limit and the Bank will manage receivables from the day of their purchasing by the Bank until the day of their repayment by the counterparty or payout of the compensation by the insurer.

Benefits:

- Access to financing on the basis of a receivables insurance agreement held by the customer.

- No additional commission charged by the Bank for takeover of the customer's insolvency risk (insurance premium is paid only to the insurer).

- Financing possible to be obtained on the basis of the list of receivables submitted electronically via the professional WEB Faktor application provided by the Bank and possibility of controlling the status of factoring settlements at any moment.

- Adjusting of the parameters of a transaction to the terms of the policy held by your company.