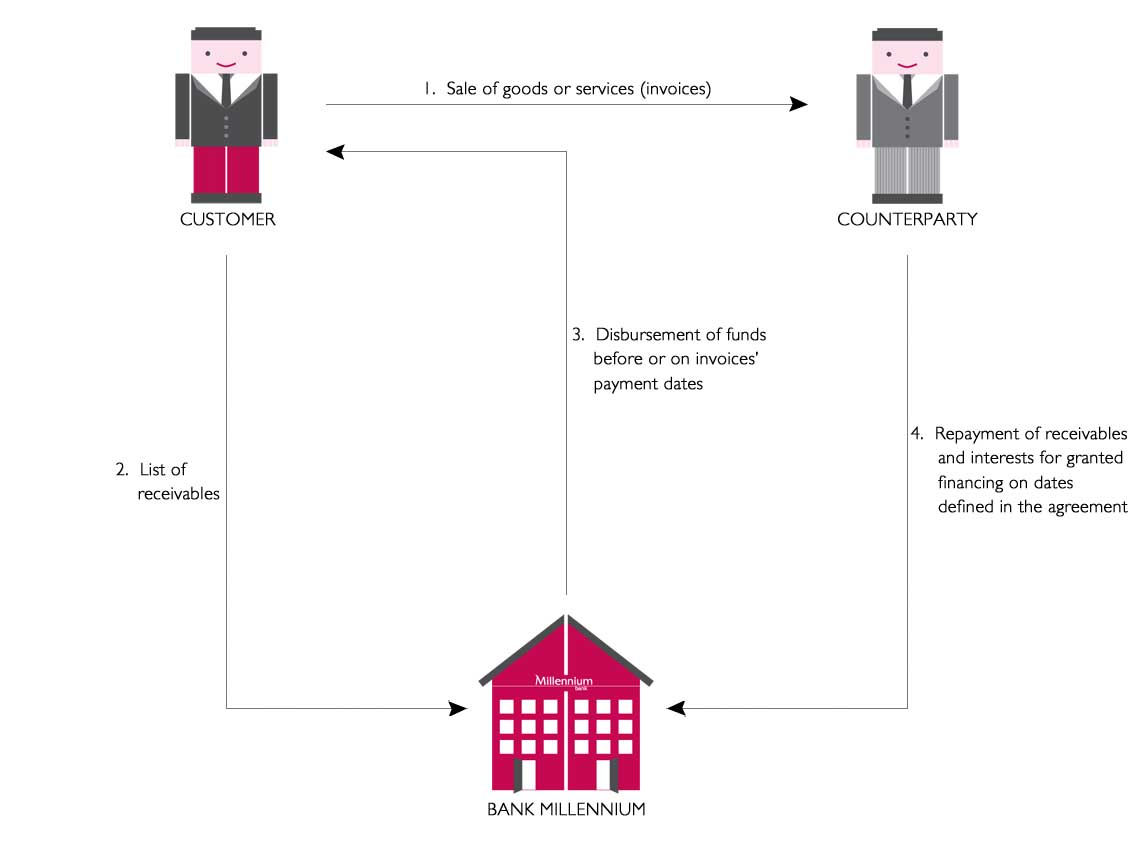

Mille-Link factoring is a factoring transaction where the Bank pays out to your company funds for purchased receivables not later than on their payment date, while the counterparty gets from the Bank an additional period to repay their liability. The cost of financing before receivables payment date is covered by the customer, if he uses disbursement before payment date, while after its payment date - by the counterparty. Moreover, the Bank does the accounting and settlement of the receivables and is responsible for the monitoring of the timeliness of repayments and dunning of receivables.

Benefits for your company:

- Certainty of getting from the Bank funds for goods or services sold on their payment date or earlier.

- Shortening of the counterparty financing period.

- Reduction of costs of trade credit given to the counterparty.

- 24/7 access to WEB Faktor application provided to you by the Bank, that support making online factoring transactions and control of the settlements' status at no additional cost.

Benefits for the counterparty:

- Extension of the receivables repayment period.

- Acquiring financing after receivables become due and payable, with no need for the counterparty to establish additional collateral.