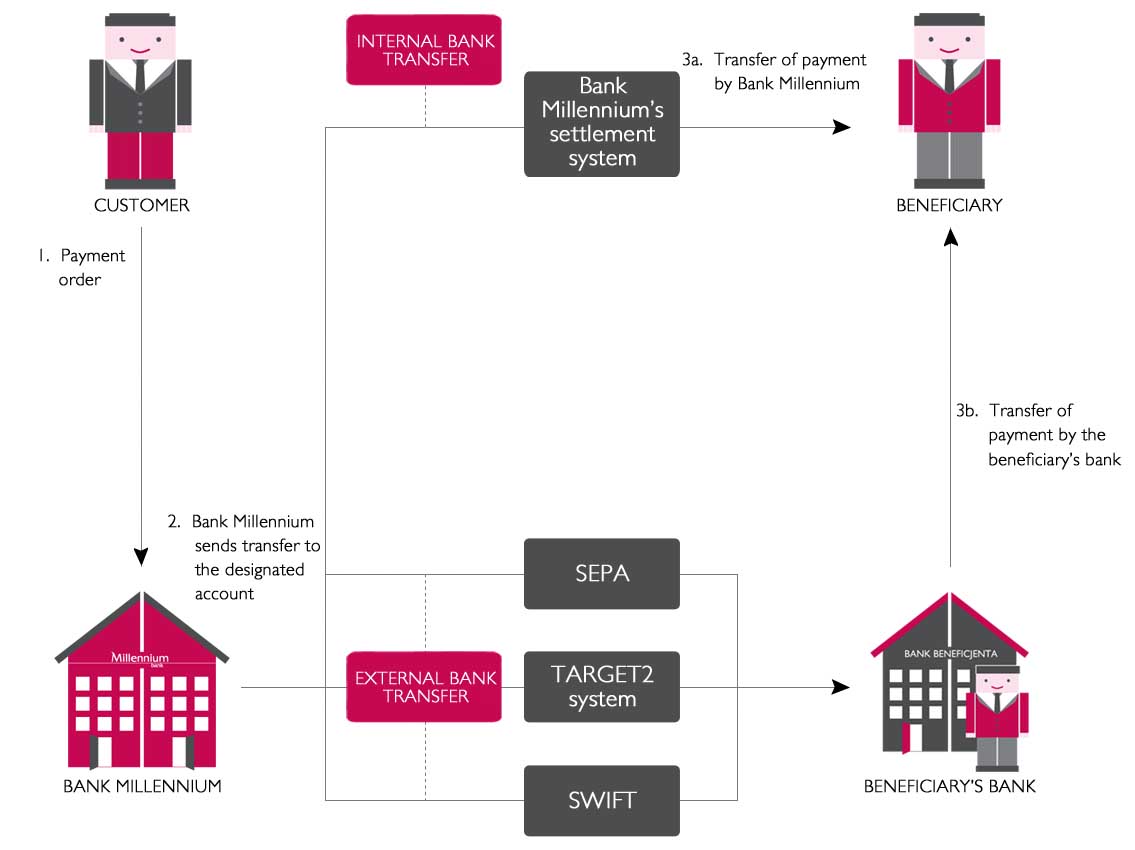

Foreign transfers will allow you to settle payments in foreign currency or in PLN to a beneficiary who has an account at a foreign bank or execute a transfer in foreign currency to a beneficiary at a domestic bank.

We offer SEPA transfers, TARGET2 express transfers and traditional foreign transfers. SEPA transfers to UE countries, Iceland, Norway, Liechtenstein and Switzerland are executed in EUR with the D+1 value date. TARGET2 express transfers are payments in EUR sent with the D+0 value date.

Using SWIFT standard for foreign transfers you can indicate value date of payment:

- standard (D+2) or (D+1) – depending on currency,

- urgent (D+1) or

- express (D).

Benefits:

- International receivables and payables settled quickly and easily.

- Non-standard execution times of transfers.

- Extended cut off times - outgoing foreign transfers, depending on type, accepted until 4:00 PM; incoming foreign transfers accepted until 5:30 PM.

- Online transfers executed in the TARGET2 system.

- Flexible deduction of fees.

- Transfers in about 130 foreign currencies.

- Transfer orders submitted at the Bank's branch and through Millenet.