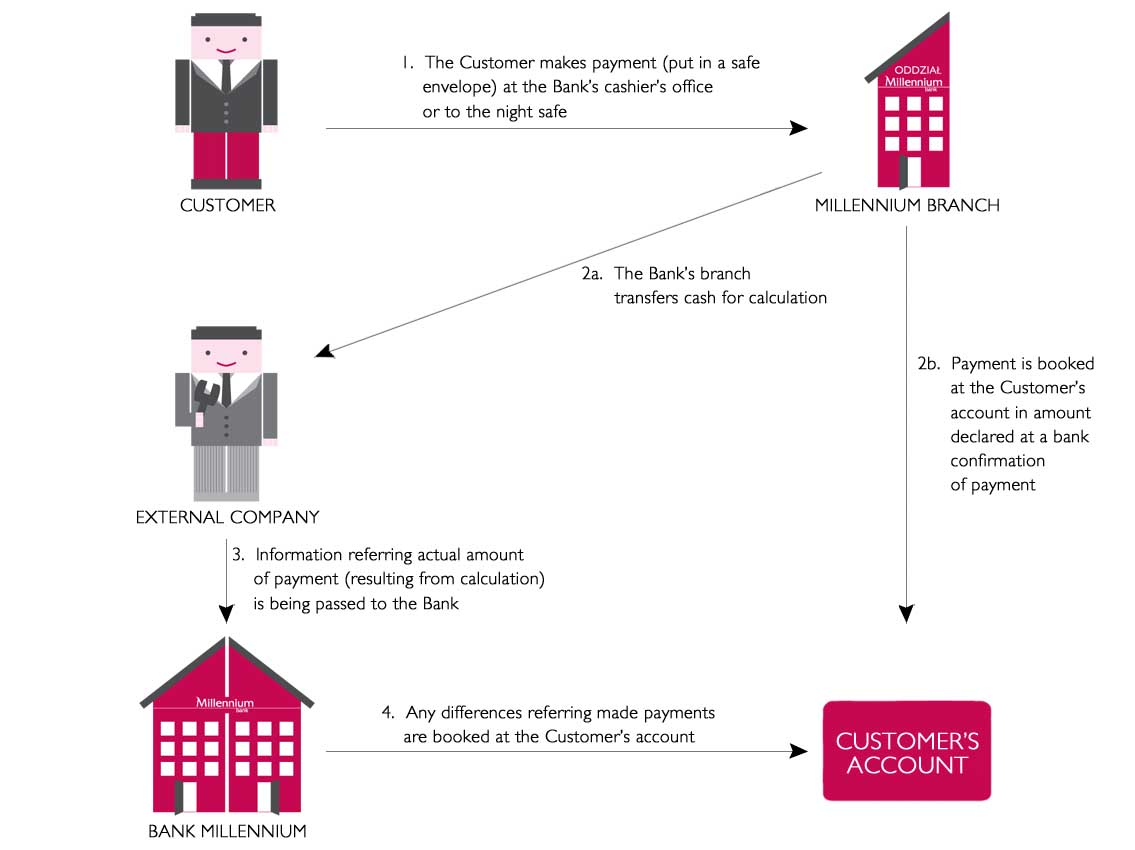

Closed cash deposit involves depositing cash without the need to count it when depositing. You can authorise members of your company staff and third persons e.g. employees of cash transport company to execute deposits of this type.

You can deposit cash in a closed form in Bank outlets or you can make use of the netrowk of Bank operated night drops as well as units and night drops operated by external companies cooperating with the Bank.

The deposit is credited by the Bank to appropriate account on the basis of data contained in deposit slip. If a difference is found between a declared amount and amount calculated, you will receive a difference report and the Bank will adjust earlier bookings accordingly.

Benefits:

- You can make use of closed deposits in any outlet of the Bank without the need to sign additional documents. List of branches, which do not handle any cash transactions or which do not accept closed deposits

- You can also deposit cash in all outlets of external companies cooperating with the Bank.

- At your disposal, you have nearly 100 night drops located in outlets of the Bank and external company outlets.

When making use of this form of depositing cash:

- You will reduce costs ― closed deposits are less expensive the open ones,

- You will save time by not having to wait for deposited cash to be counted,

- You will minimise your cash turnover risk – by maintaining, in your company units, only amounts of cash required to finance current operations.